Introduction to Minimum Wages Act:

The India’s Minimum Wages Act 1948 is a significant piece of labour legislation in India designed to protect workers in unorganised sectors by setting minimum wages for various occupations.

In India, certain minimum salaries to certain categories of workers or employees, as updated from time to time by the labour laws compliances. According to “India’s minimum wage” in labour laws, employers are required to pay minimum wages.

Definition of Wages:

Wages refer to the remuneration provided by an employer to an employee in return for the services rendered.

This payment is usually determined by factors such as time worked (hourly, daily, weekly, monthly, or yearly), the amount of items produced, or the completion of designated tasks.

Provisions under Minimum Wages Act 1948:

The Minimum Wages Act of 1948 is a comprehensive piece of legislation aimed at establishing minimum wage rates to ensure that workers receive fair remuneration.

Here is a detailed overview of the provisions in the Act:

Inspections and Compliance under Minimum Wage:

Inspections under the Minimum Wages Act of India:

Minimum Wage inspections and compliance are critical components of India Minimum Wages Act, 1948, designed to ensure that employers adhere to the provisions of the Act.

Section 19: Appointment of Inspectors

The appointment of inspectors is the responsibility of the relevant government (federal or state). Inspectors are responsible for making sure employers are adhering to the Act’s obligations.

Section 19(2): Powers of Inspection

Inspectors have the authority to:

- Gather proof and demand that the employer reveal the amount of money that employees were paid.

- Examine any other pertinent records or paperwork kept in relation to employment and salary disbursement.

- Go into any location where workers are engaged to conduct inspections.

- Examine wage books or other documentation to make sure that records are maintained properly.

The Minimum Wages Act key impacts:

Penalty Provisions under the Minimum wages Act:

The Act imposes penalties on employers who fail to pay the minimum wage or violate other provisions of the Act. This serves as a deterrent against non-compliance and safeguards workers’ rights to receive fair wages.

Government Intervention in Minimum wage

- The legislation grants authority to both central and state governments to determine and revise minimum wages for different employments. This intervention plays a critical role in safeguarding the interests of workers across various industries, particularly in sectors where contract labour is disorganized and susceptible to exploitation.

- The Minimum Wages Act in India has significantly improved the living standards of millions of workers by guaranteeing fair wages, thereby reducing income inequality and promoting social justice.

- Despite its noble intentions, the enforcement of the Act has faced challenges, particularly in the unorganized sector, due to inadequate monitoring and Minimum wages compliance. Critics argue that the fixed minimum wages are still insufficient to meet the basic needs of workers in certain regions.

Minimum wage in India 2021 Amendment

- The Act has evolved through various amendments to adapt to changing economic conditions and labour market dynamics. The 2021 amendment focused on updating wage rates to align with current economic realities, as part of the broader reform under the Code on Wages, 2019.

- To ensure labour laws compliance, the Act includes provisions for the appointment of inspectors and advisory boards. These mechanisms play a crucial role in monitoring and enforcing minimum wage standards, ensuring that employers adhere to the regulations.

- The impact of the Minimum Wages Act on the labour market has been positive, promoting wage equity, improving economic conditions for low-wage workers, and reducing wage disparity. It highlights the importance of government regulation in protecting vulnerable workers and fostering equitable economic growth. Efforts are ongoing to enhance implementation and expand coverage of the Act.

26 Days minimum wage rules in India:

In India, minimum wages are typically calculated based on a standard 26-day working month to ensure fair and consistent pay for workers across various sectors and regions.

Here are the key points regarding the 26-day minimum wage rules:

Standard Work Month

Minimum wages are calculated for a 26-day working month, assuming a 6-day workweek with one day off.

Daily Wage Calculation

The monthly minimum wage is divided by 26 to determine the daily wage, ensuring a consistent daily rate.

Wage Protection

Employers must pay at least the minimum wage to eligible workers, with penalties for non-compliance.

Applicability

The 26-day rule applies to different sectors under central and state minimum wage laws, with variations based on state regulations or industry requirements.

Overtime Pay

Workers receive overtime pay for hours worked beyond the standard 8-hour workday, typically at twice the regular hourly rate.

Revisions & Updates

Minimum wages are periodically revised by central and state governments to account for changes in the cost of living and inflation.

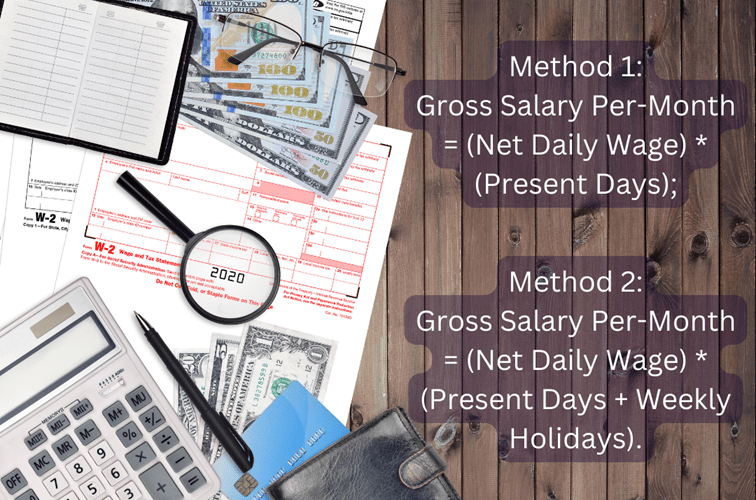

Daily Wage Calculator Formula:

There are two ways to calculate this:

Method 1:

Gross Salary Per-Month = (Net Daily Wage) * (Present Days);

Method 2:

Gross Salary Per-Month = (Net Daily Wage) * (Present Days + Weekly Holidays).

Example of Daily Wage Calculation

If the monthly minimum wage for a worker is set at INR 13,000, the daily wage would be calculated as:

Daily Wage = 13,000/26 approx. 500 Rupees/Day

For the latest and specific rules, it is recommended to consult official notifications from the Ministry of Labour and Employment or relevant state government authorities.

This standardized approach guarantees fair compensation for workers and maintains transparency and consistency in wage calculations across various employment settings.

Annual leave with wages in India:

In India, the provision for annual leave with wages is governed by the Factories Act, 1948, rather than the Minimum Wages Act.

Here are the key details regarding annual leave with wages under the Factories Act:

Workers who have completed a minimum of 240 days of work in a calendar year are eligible for annual leave with wages.

The 240 days include all days of actual work, holidays, and paid leave.

For adults, the entitlement is 1 day of leave for every 20 days of work.

For children, the entitlement is 1 day of leave for every 15 days of work.

Unused leave can be carried forward to the following year, but it should not exceed 30 days for adults and 40 days for children.

During the leave period, wages as per minimum wages act should be paid at the average daily wage rate. The calculation of this rate involves dividing the worker’s total earnings from the last three months by the number of days worked within that timeframe.

The wages must be paid prior to the start of the leave if it is for four or more days.

It is necessary for employees to submit written leave requests. The employer’s decision to grant leave is final and takes operational efficiency into account.

A worker must be paid the equivalent of the leave time they did not take if they quit their job before using their allotted leave.

In the event that an employee works 300 days in a year, their leave entitlement would be determined as follows:

Vacation Days = 300/20 = 15 days off

These rules take into account operational needs while ensuring that workers receive fair leave benefits. It is advised to refer to the most recent notifications and amendments made in accordance with the Factories Act, 1948, for more detailed information and any updates.

State wise Minimum wage in India

This table presents an overview of the approximate minimum wage for unskilled workers across different states in India, based on the most recent data available:

| State | Minimum Wage (INR per day) |

|---|---|

| Andhra Pradesh | 210 - 300 |

| Assam | 240 - 350 |

| Bihar | 200 - 275 |

| Chhattisgarh | 220 - 290 |

| Delhi | 534 (Maximum wage) |

| Goa | 307 - 465 |

| Gujarat | 280 - 365 |

| Haryana | 318 - 401 |

| Himachal Pradesh | 225 - 300 |

| Jharkhand | 225 - 300 |

| Karnataka | 275 - 365 |

| Kerala | 310 - 600 |

| Odisha | 200 - 300 |

| Punjab | 312 - 415 |

| Rajasthan | 225 - 300 |

| Tamil Nadu | 250 - 350 |

| Telangana | 237 - 350 |

| Uttar Pradesh | 225 - 300 |

| Uttarakhand | 225 - 300 |

| West Bengal | 257 - 370 |

| minimum wages in Maharashtra | 350 - 400 |

| minimum wages in MP | 200 - 290 |

| minimum wages in Bihar | 200 - 275 |

Central Minimum Wages (Approximate, as of the latest updates) in INR per day:

The approximate minimum sealery for minimum wages—notification of the Central Labour Commissioner—is summarized in the following table.

| Category | Unskilled | Semi-skilled | Skilled | Highly Skilled |

|---|---|---|---|---|

| Agriculture | 178 – 225 | 202 – 250 | 237 – 287 | 263 – 335 |

| Construction/Building | 335 | 364 | 395 | 438 |

| Manufacturing | 335 | 364 | 395 | 438 |

| Mining | 350 | 380 | 410 | 450 |

| Services (e.g., Cleaning) | 300 | 330 | 360 | 400 |

Notes:

The kind of industry and the workers’ skill level are two of the many factors that go into determining the minimum wages set by the central government.

Within the industries covered by the central government’s minimum wage regulations, the wages for labour rates may differ slightly depending on certain conditions or locations.

The Ministry of Labour and Employment may periodically review and amend these rates.

Please consult the official notifications from the Indian government’s Ministry of Labour and Employment for the most accurate and recent information.

All compliances registers maintaining under The Minimum wage Act

The Minimum Wages Act, 1948, mandates that employers maintain specific registers to ensure compliance with minimum wage standards and related provisions. Below is a detailed list of the compliance registers required under this act in India, along with the details for each:

Minimum Wages Act, 1948 Compliance Registers

| Register Name | Details |

|---|---|

| Register of Fines (Form I) | Records all fines imposed on employees, reasons for the fines, amounts, and dates of imposition. |

| Register of Deductions for Damage or Loss (Form II) | Details all deductions made from employees' wages for damage or loss caused by the employee, including reasons and amounts. |

| Register of Wages (Form IV) | Comprehensive record of wages paid to each employee, including basic wages, allowances, deductions, and net pay. |

| Overtime Register (Form V) | Records overtime hours worked by each employee, rates of overtime wages, and amounts paid for overtime work. |

| Wage Slip (Form XI) | Issued to each employee at the time of wage payment, detailing gross wages, deductions, and net pay. |

| Register of Employment (Form III) | Details of all employees, including name, designation, rate of wages, attendance, and other relevant employment details. |

| Register of Loans and Advances (Form VI) | Records details of loans and advances given to employees, including amounts, dates, and repayment terms. |

| Register of Muster Roll (Form V) | Daily attendance record of all employees, capturing their presence and absences. |

Detailed Explanation of Minimum Wages Act Compliance Registers:

Summary of the 1984 Minimum Wage Act

- India’s Minimum Wages Act of 1948 is a critical piece of legislation in the context of labour laws in India. It fixes the minimum wage rates for specific occupations in an effort to protect workers’ welfare. The Minimum Wages Act of 1948 is a key piece of legislation that ensures economic justice for Indian workers.

- By mandating minimum wage standards, the Act seeks to protect workers from exploitation, provide them with a basic standard of living, and promote social equity. While it has positively impacted workers’ lives, effective implementation remains a challenge, necessitating ongoing efforts to enhance labour laws compliance and enforcement.

- Minimum pay India is a vital component of the framework for Indian labour laws since it demonstrates the nation’s dedication to just labour practices and workers’ rights.

Minimum wages Act Important FAQs:-

What is the Minimum Wages Act, and why was it enacted?

The Minimum Wages Act, 1948, is an Indian labor law that ensures workers receive a fair minimum wage. The Act was enacted to protect low-wage workers from exploitation, ensuring they earn enough to cover basic needs, like food, shelter, and health.

What is the objective of the Minimum Wages Act, 1948?

The primary objective of the Minimum Wages Act, 1948, is to prevent the exploitation of workers by mandating a minimum wage in various sectors. It sets a minimum income level to guarantee that employees are paid enough to meet their basic living expenses.

Who is covered under the Minimum Wages Act, 1948?

The Minimum Wages Act applies to employees across scheduled employments as listed in the Act, which includes sectors like construction, agriculture, and manufacturing. Both skilled and unskilled workers are covered to ensure fair pay.

How is the minimum wage determined under the Minimum Wages Act?

Minimum wages under the Act are determined by considering factors like cost of living, skill level, and nature of work. State governments are responsible for setting wage rates in their regions to reflect local economic conditions.

What is the difference between minimum wage and fair wage?

The minimum wage is the legally mandated minimum payment, whereas a fair wage considers additional factors, such as industry standards and workers’ needs. The Minimum Wages Act only guarantees the basic minimum wage, not necessarily a fair wage.

What is the penalty for non-compliance with the Minimum Wages Act?

Employers who do not comply with the Minimum Wages Act can face fines and even imprisonment. Penalties are imposed for non-payment of minimum wages, delayed payment, or unauthorized deductions from wages.

What are the benefits of the Minimum Wages Act for employees?

The Minimum Wages Act provides financial security, improved living standards, and protection against exploitation for employees. By guaranteeing a base level of earnings, the Act helps workers afford essentials like food, healthcare, and housing.

Are allowances like HRA included in minimum wage calculation?

House Rent Allowance (HRA) and other allowances are typically not included in the minimum wage calculation, as the Act defines minimum wages as a basic wage. However, some allowances may be added based on state-specific rules.

What records must employers maintain under the Minimum Wages Act?

Employers must keep records of wage payments, working hours, and overtime under the Minimum Wages Act. These records are essential for ensuring transparency and compliance during inspections.

How often is the minimum wage revised under the Minimum Wages Act?

Minimum wages are typically revised every five years, although some states revise them more frequently to reflect inflation and cost of living changes. Revisions aim to maintain the wage’s relevance and fairness over time.