Introduction to Payment of Bonus Act:

The Payment of Bonus Act, 1965 is a significant legislation in India that ensures the provision of bonuses to employees working in a specific establishment. The primary objective of this act is to bridge the gap between the rich and the poor by allowing employees to partake in the success of the company. It aims to distribute the benefits of a company’s prosperity equitably among its employees to foster social justice and economic equality. In India, bonus is paid on Diwali, hence it is sometimes called Diwali Bonus act in most companies.

Statutory Bonus Meaning in India:

The legal requirement for employers to provide a specific amount of money to their employees, known as the statutory bonus, is governed by labour laws in various countries, including India. The Payment of Bonus Act, 1965, in India, stipulates that eligible employees must receive bonuses based on their earnings and the company’s profits. The bonus is calculated as a percentage of the employee’s salary, with minimum and maximum limits set by the Act.

Historical Context:

Prior to the implementation of the Payment of Bonus Act, the concept of bonuses lacked consistency, resulting in disparities and discontent among employees. To address this issue, the Indian Government established a Bonus Commission in 1961 to examine and propose a comprehensive bonus payment scheme. The recommendations put forth by this commission eventually led to the enactment of the Payment of Bonus Act in 1965.

For businesses, Labour laws compliance with the Bonus Act is not only a legal obligation but also a step towards building a motivated and satisfied workforce. Understanding the nuances of this Act is important to ensure that employers and employees are able to implement the benefits prescribed by labour laws in India. With periodic amendments and judicial interpretations, the law continues to evolve to reflect the changing economic landscape and workforce needs. This is a testament to the Indian Parliament’s commitment to ensure fair labour practices and promote social justice.

Objectives of the Bonus Act 1965:

The primary goal of the Payment of Bonus Act, 1965 is to grant employees a legal entitlement to receive bonuses from their employers. The act stipulates both minimum and maximum bonus amounts to be paid based on the company’s profits, ensuring that employees are entitled to a portion of the profits.

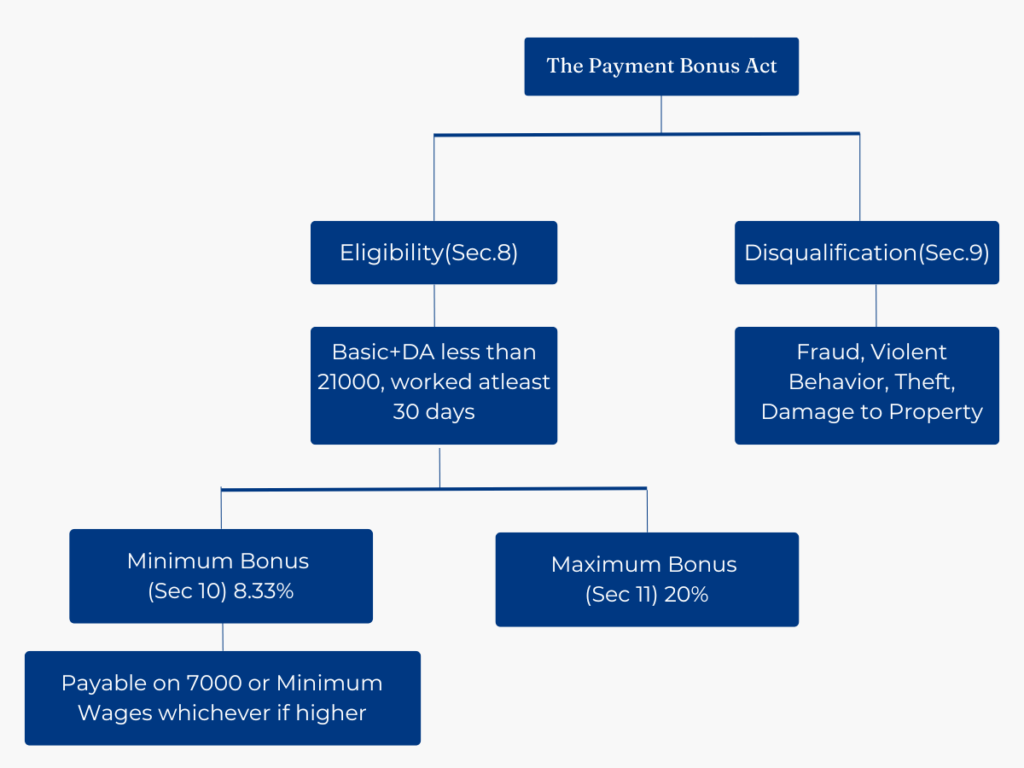

Bonus Eligibility Criteria:

- To be eligible for a bonus, employees must have completed a minimum of 30 working days during the accounting year.

- Additionally, employees who earn a salary or wage of ₹21,000 or less per month are also eligible for the bonus.

The Payment Bonus Act Applicability and Scope:

What is covered by the Payment of Bonus Act of 1965 is:

- Employees Covered: Employees drawing a salary or wage not exceeding ₹21,000 per month.

- All factories as specified by the Factories Act of 1948.

- Minimum Working Days: Employees must have worked for at least 30 working days in that year to be eligible.

The act extends to various other establishments as designated by the Government through notifications. However, it does not apply to specific categories of employees, including those in the Life Insurance Corporation, seamen, employees under dock workers’ management boards, employees in industries operated by or under the authority of any department of the Central Government or a State Government, among others.

Definitions under the Bonus Act:

An “employee” under the Payment of Bonus Act is any person (other than an apprentice) employed on a salary or wage not exceeding Rs. 21,000 per month in any industry to do any skilled or unskilled, manual, supervisory, managerial, administrative, technical, or clerical work.

An “establishment” means any place where any industry, trade, business, manufacture, or occupation is carried on. This includes factories, shops, mines, and other places where workers are employed.

“Salary or wages” includes basic pay, dearness allowance, and any other allowances, excluding other benefits such as provident fund, pension, bonus, traveling allowance, gratuity, etc

Payment of Bonus calculation:

Minimum and Maximum Bonus:

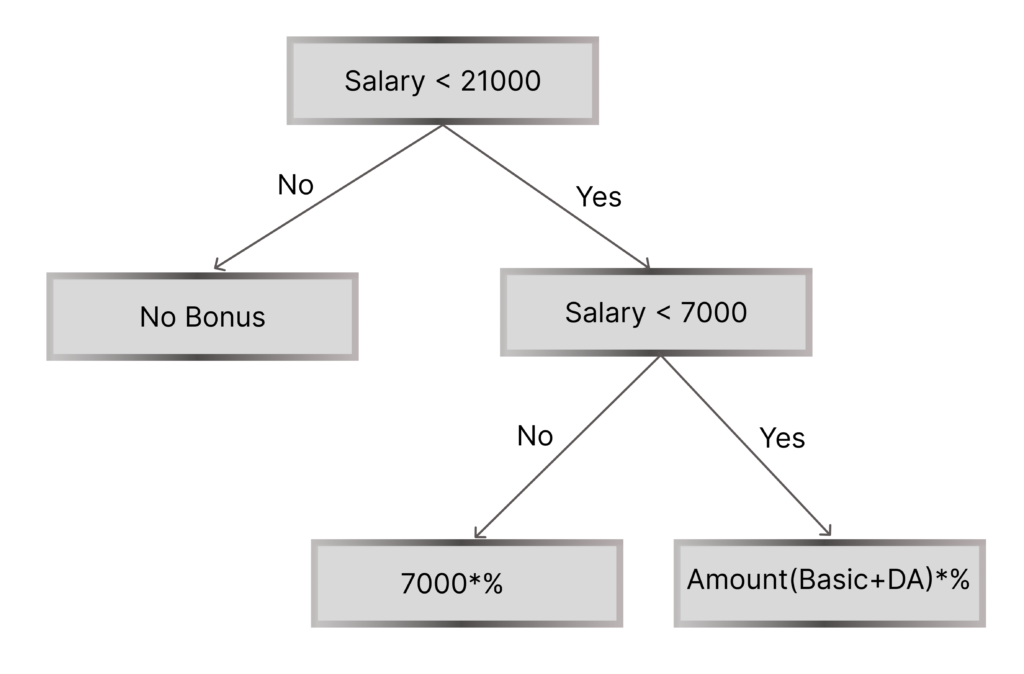

The Act specifies the minimum and maximum limits of bonus payable:

- Minimum Bonus: 8.33% of the salary or wages or Rs. 100 (whichever is higher), regardless of whether the employer has made any profit.

- Maximum Bonus: 20% of the salary or wages, provided the employer has sufficient allocable surplus.

- Allocable Surplus: Refers to 67% of the available surplus in case of a company other than a banking company and 60% in case of a banking company.

- Available Surplus: Is computed according to the rules laid down in the Payment of Bonus Act, which include deducting certain prior charges (such as depreciation, development rebate or investment allowance, etc.) from the gross profits.

Turn on and turn off Additionally, provisions for “set-on” and “set-off” of allocable surplus are included in the Payment of Bonus Act. If, in any year, the allocable surplus exceeds the amount required for payment of the maximum bonus, the excess shall be carried forward to be “set-on” in the succeeding accounting years up to and including the fourth accounting year. Conversely, if there is a shortfall, the amount of minimum bonus paid can be “set-off” against the allocable surplus of the succeeding accounting years up to and including the fourth accounting year.

- Time Limit: The bonus must be paid within eight months from the close of the accounting year. However, the government can extend this period upon request and for sufficient reasons.

- Mode of Payment: The payment of bonus should be made through cash, cheque, or direct credit to the bank account of the employee.

Rights and Obligations under Payment of Bonus Act :

- Right to Receive Bonus: Employees have the right to receive a minimum bonus irrespective of profits.

- Right to Inspect Registers: Employees can inspect the registers maintained by the employer related to the payment of bonuses.

- Maintain Records: Proper maintenance of records and registers as specified under the Payment of bonus act.

- Timely Payment: Employers must ensure timely payment of the statutory bonus.

If any amount payable to an employee under the Payment of Bonus Act remains unpaid, It is recouped in the same way as if it were unpaid land revenue. This ensures that employees receive their due bonuses without unnecessary delay.

An employee can be disqualified from receiving a bonus if they are dismissed from service due to:

- Fraud

- Riotous or violent behaviour

- Theft, misappropriation, or sabotage of any property of the establishment

Non-compliance with the provisions of the Payment of Bonus Act can lead to penalties, which include:

- Fine: The employer can be fined which may extend to Rs. 1,000.

- Imprisonment: The employer can also face imprisonment for a term which may extend to six months, or both fine and imprisonment.

Implementation and Compliance under Payment of Bonus Act:

Record-Keeping

It is mandatory for employers to keep accurate records of bonus calculations, allocable surplus, set-on and set-off amounts, and employee payments.

Resolving Disputes

In case of any disagreements concerning statutory bonus disbursements, the matter can be escalated to the labour court or industrial tribunal for resolution.

Regulatory Checks

Regulatory bodies are authorized to conduct inspections and audits on employer records to verify adherence to the regulations.

Diwali Bonus 2025

Summery of Payment of Bonus Act :

The Payment of Bonus Act, 1965 is a landmark in Indian labour law. Mandating payment of bonus to employees ensures that they have a stake in the financial success of the company they work for. This makes workers feel motivated and like they belong. Meanwhile, it encourages employers to maintain transparency and fairness in financial transactions, thereby promoting a fairer and more just working environment.

Payment of bonus Act FAQs-

What is the Payment of Bonus Act, 1965?

The Payment of Bonus Act, 1965 is an Indian labour law that mandates payment of bonuses to employees of certain establishments based on their salary and company profits. The Act applies to establishments with 20 or more employees and ensures employees share in the company’s success.

Who is eligible for a bonus under the Payment of Bonus Act?

Employees earning a salary of up to ₹21,000 per month are eligible for bonuses under the Payment of Bonus Act. They must have worked in an establishment for at least 30 days during the financial year to qualify.

Who is eligible to receive a Diwali Bonus under the Payment of Bonus Act?

Employees are eligible if they:

- The establishment employs 20 or more persons.

- Have worked at least 30 days in the financial year, and

- Earn a monthly salary or wage up to ₹21,000, and

How is the bonus amount calculated under the Payment of Bonus Act?

The bonus amount is calculated based on profits or production of the establishment. The Act sets a minimum bonus of 8.33% and a maximum bonus of 20% of the salary, depending on company profitability and individual performance.

What is the minimum bonus payable under the Payment of Bonus Act?

Under the Act, the minimum bonus payable to eligible employees is 8.33% of their salary or wage, regardless of company profit status. This minimum ensures employees receive a share even in low-profit years.

What is the difference between statutory and discretionary bonus?

A statutory bonus is mandated by the Payment of Bonus Act for eligible employees, while a discretionary bonus is additional and given voluntarily by the employer. The Act governs statutory bonuses, which are mandatory, but not discretionary ones.

Are seasonal employees eligible for a bonus under the Payment of Bonus Act?

Yes, seasonal employees are also eligible for a bonus, calculated based on the period of their employment during the season. However, the bonus may vary from that of regular employees, reflecting the shorter employment period.

What records must employers maintain under the Payment of Bonus Act?

Employers must maintain bonus calculation records, employee salary details, and disbursement records for compliance. These records are essential during audits by labour authorities and ensure transparent bonus distribution.

What is the penalty for non-compliance with the Payment of Bonus Act?

Non-compliance with the Payment of Bonus Act can lead to penalties, including fines and potential imprisonment for employers. Penalties are imposed for failure to pay bonuses on time or inaccurately, ensuring accountability.

Is the bonus taxable under the Payment of Bonus Act?

Yes, bonuses paid under the Payment of Bonus Act are considered part of taxable income and are subject to income tax as per the employee’s applicable tax bracket. Employers are required to deduct tax at source on bonus payments.

What is the due date for filing the Bonus Return under the Payment of Bonus Act?

Bonus is to be paid within Eight months of closure of the financial year and the return is to be filed within 30 days after payment as prescribed in Section 19 of the Act

Where should the Bonus Return be filed?

Employers must file the Bonus Return with the relevant Labour Commissioner’s Office or the designated authority in their state. The filing process may vary by state, so it’s important to check specific guidelines for correct submission.

Is Diwali Bonus taxable?

Yes, the Diwali Bonus is treated as income from salary and is taxable as per the Income Tax Act.

Is the Diwali Bonus applicable to all private companies?

Yes, the Payment of Bonus Act, 1965 applies to all factories and establishments employing 20 or more persons, including private companies.

Can a company link Diwali Bonus with performance?

Yes, companies may pay an additional ex-gratia or performance bonus during Diwali apart from the statutory bonus, based on employee performance or company profitability.

Can a company deny paying a bonus due to losses?

If a company incurs a loss, it may still need to pay the minimum bonus (8.33%), as per the Act, provided it had profits in earlier years or maintains a set-off or set-on balance.

What form is used to file the Bonus Return under the Payment of Bonus Act?

Form D is used to file the Bonus Return under the Payment of Bonus Act, 1965. This form requires details about the bonus paid, the amount distributed, and eligible employees. Correctly filling Form D is crucial for compliance.

Is there a penalty for late filing of the Bonus Return?

Yes, late filing of the Bonus Return can result in penalties. Employers may face fines or even legal actions for failing to meet the filing deadline as specified by the Payment of Bonus Act.

What are the penalties for non-payment of bonus?

Failure to pay a statutory bonus can lead to penalties under Section 28 of the Payment of Bonus Act, including fines and imprisonment.

What information is required to file the Bonus Return?

The Bonus Return requires details such as total employees, amount of bonus paid, distribution details, and compliance with minimum and maximum bonus limits. Complete and accurate data is essential for successful submission.

How should employers keep records for Bonus Return filing?

Employers must maintain accurate records of bonus calculations, employee eligibility, and payments to facilitate the Bonus Return filing. These records should be kept for audits and inspections by the labour department.

Can the Bonus Return filing date be extended?

Extensions for the Bonus Return filing date are typically not granted unless exceptional circumstances arise, and only then by the relevant authority. Employers are advised to file within the original deadline to avoid penalties.

What are the compliance requirements for employers?

Employers must:

- Ensure transparency and uniformity in bonus distribution.

- Maintain proper bonus registers and records,

- Calculate and disburse the bonus within the due date,

- File necessary annual returns under the Payment of Bonus Act, and

What is a Diwali Bonus?

A Diwali bonus refers to a financial reward provided by employers to their employees as part of the festive celebration. This bonus, usually given during the Diwali festival, is an expression of appreciation for the employees’ hard work throughout the year. In certain industries, like manufacturing and retail, paying bonuses during Diwali is even mandatory under labour law compliance norms.

When should the Diwali Bonus be paid?

As per the Act, the bonus should be paid within 8 months from the close of the accounting year. However, most employers pay it before Diwali to coincide with the festive season.

Is the Diwali Bonus Mandatory in India?

While the Payment of Bonus Act, 1965 mandates annual bonuses in industries employing a certain number of people, Diwali bonuses are often provided as a gesture beyond the legal requirement. However, some companies incorporate the bonus into their regular compliance practices, ensuring that it aligns with both labour law obligations and employee welfare policies.

Many firms see the Diwali bonus as a powerful retention tool. It enhances loyalty and strengthens the employer-employee relationship, making it a significant aspect of employee engagement strategies.

How Companies Decide Diwali Bonuses?

Bonuses may vary depending on company policies, profits, and employee performance. Some common types of Diwali bonuses include:

- Fixed Bonuses: A set amount for all employees, usually applicable to entry-level staff.

- Performance-based Bonuses: Rewards tied to individual or team performance over the year.

- Profit-sharing Bonuses: A portion of the company’s annual profits distributed among employees.

In the case of organized sectors, particularly manufacturing, bonuses may be regulated to ensure labour law compliance. For companies listed under industrial licensing laws or factory compliance rules, specific bonuses may be pre-defined or contractually mandated.

Tax Implications of Diwali Bonuses

The Diwali bonus is considered part of taxable income under Indian income tax laws. Employers deduct tax at source (TDS) on the amount distributed to employees. However, many organizations still provide this benefit to foster goodwill and maintain employee satisfaction.

Are contractual or temporary employees eligible for a Diwali Bonus?

Yes, if they meet the eligibility criteria under the Payment of Bonus Act—that is, if they have worked at least 30 days and their wages are within the prescribed limit.

- Fixed Bonuses: A set amount for all employees, usually applicable to entry-level staff.

- Performance-based Bonuses: Rewards tied to individual or team performance over the year.

- Profit-sharing Bonuses: A portion of the company’s annual profits distributed among employees.

In the case of organized sectors, particularly manufacturing, bonuses may be regulated to ensure labour law compliance. For companies listed under industrial licensing laws or factory compliance rules, specific bonuses may be pre-defined or contractually mandated.

Tax Implications of Diwali Bonuses

The Diwali bonus is considered part of taxable income under Indian income tax laws. Employers deduct tax at source (TDS) on the amount distributed to employees. However, many organizations still provide this benefit to foster goodwill and maintain employee satisfaction.

Contact Us for Labour Laws Compliance

Ensure your business meets all Labour Laws Compliance requirements. Learn about essential regulations, compliance checklists, and expert advice to avoid penalties. Stay informed on employee rights and legal obligations.