Introduction

The Shop and Establishment Act, often referred to as the Shops and Establishments Act, is a state-specific legislation enacted across India to regulate conditions of work and employment in shops, commercial establishments, and other workplaces. The primary objective of this act is to ensure proper working conditions, rights of employees, and compliance with rules governing establishments where goods and services are sold, exchanged, or distributed.

The Shops and Establishments Act Aim

The Shops and Establishments Act aims to create a uniform regulatory framework for businesses, promote decent working conditions, protect the rights of employees, and ensure proper management practices in various commercial establishments across India. Each state or union territory may have its own Shops and Establishments Act with specific rules tailored to local requirements and circumstances.

Importance of the Shops and Establishments Act

The Shops and Establishments Act holds significant importance for both businesses and employees in India due to several key reasons:

Key Provisions of the Shops and Establishments Act

The regulations concerning working hours under the Shops and Establishments Act are crucial for ensuring fair labour practices and maintaining employee welfare. While specific details can vary between states in India, the general provisions typically include:

- Defines the spread-over period, which is the total duration including breaks that an employee can be required to work.

- Mandates rest intervals or breaks during working hours, ensuring that employees have time for meals and rest.

- The Act sets limits on the maximum number of hours an employee can work per day and per week.

- For example, it may specify that employees should not work more than 9 hours a day or 48 hours a week (including overtime).

- Prescribes conditions under which overtime work may be permitted, such as emergencies or urgent work requirements.

- Specifies the rate of overtime pay or compensatory off that employees are entitled to for work done beyond regular working hours.

Establishes rules for night shifts, including provisions for additional compensation, transport facilities, and safety measures for employees working during night hours.

Ensures transparency and accountability in managing working hours and compliance with statutory requirements.

Requires employers to maintain records of working hours, attendance, and overtime worked by employees.

Provides for a compulsory weekly holiday (usually Sunday or any other day of the week as agreed upon) for all employees.

- Specifies that employees should not be required to work on this day, except under certain conditions or in specified sectors where continuous operations are essential.

- A weekly holiday is a mandatory day of rest given to employees every week.

- In most states, Sunday is the designated weekly holiday, but establishments can choose another day of the week with prior notice to the authorities.

- This ensures that employees have at least one day off per week to rest and rejuvenate.

- These holidays vary based on the religious and cultural diversity in India. For example, Diwali, Eid, Christmas, etc., are festival holidays depending on the region and establishment.

- Festival holidays are granted to employees on specific days that hold religious, cultural, or national significance.

- Employees are entitled to a paid holiday on these days, regardless of their religion or region.

- These holidays include occasions such as Republic Day (January 26), Independence Day (August 15), Gandhi Jayanti (October 2), etc.

- National holidays are public holidays that are observed nationwide across India.

- Casual leave, also known as earned leave or privilege leave, is typically granted at the discretion of the employer.

- It allows employees to take time off for personal reasons, emergencies, or unplanned events.

- The number of casual leave days granted may vary based on the employment contract or company policy.

- The Shops and Establishments Act may specify the number of sick leave days an employee is entitled to and the conditions under which it can be availed.

- Sick leave is provided to employees for periods when they are unable to work due to illness or health-related issues.

- Maternity leave is granted to female employees during pregnancy and after childbirth to enable them to recover and care for their newborn.

- Paternity leave is granted to male employees to support their spouse during childbirth and to care for the new born.

- These leaves are typically governed by specific laws such as the Maternity Benefit Act and Paternity Benefit Act, in addition to provisions under the Shops and Establishments Act.

Restrictions and regulations and Employment of Children and Women:

The Shop and Establishment Act imposes restrictions and regulations to protect the employment rights of children and women. For children, the Act typically prohibits employment below a certain age, often 14 years, and restricts working hours and conditions for those above the minimum age. For women, the Act may include provisions such as prohibiting work during certain hours (e.g., late nights), ensuring safe and healthy working conditions, and providing maternity leave and other benefits. These regulations aim to ensure fair treatment and safe working environments for vulnerable groups.

The Shop and Establishment Act imposes several restrictions and regulations to safeguard the employment of children and women:

1. Prohibition of Employment: Children below a certain age (often 14 years) are generally prohibited from being employed in any establishment.

2. Working Hours: For those above the minimum age but still minors (typically 14-18 years), there are restrictions on working hours, often limiting them to a maximum of 6 hours per day and prohibiting night shifts.

3. Health and Safety: Employers must ensure a safe working environment, free from hazardous conditions.

1. Working Hours: Women may be restricted from working during late-night hours, often between 9 PM and 6 AM, to ensure their safety.

2. Maternity Benefits: Provisions for maternity leave and other related benefits must be provided as per the law.

3. Safety and Welfare: Employers must ensure a safe and healthy working environment, including measures to prevent harassment and provide necessary facilities such as restrooms and rest areas.

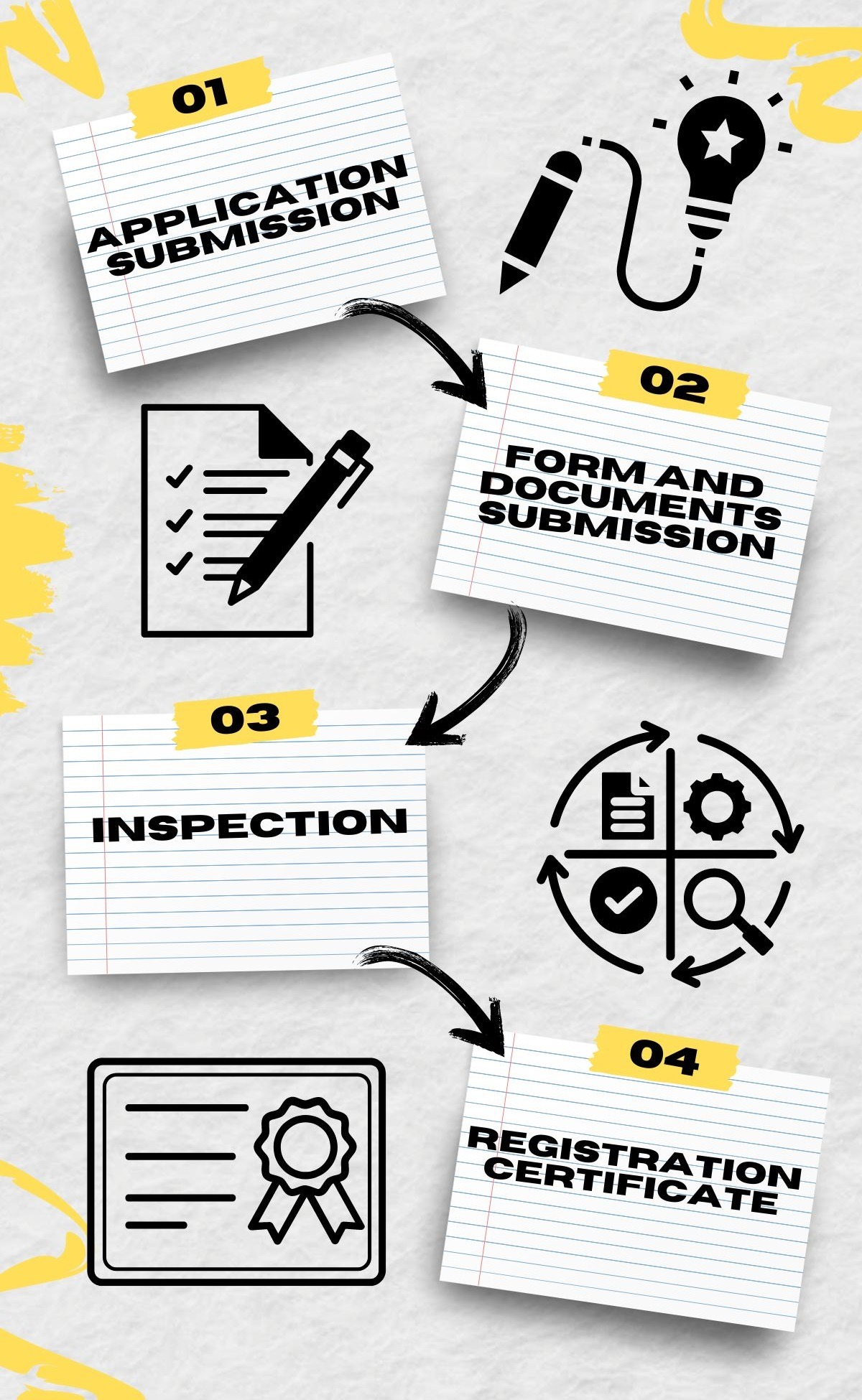

Registration and Renewal Process

The registration and renewal process under the Shop and Establishment Act typically involves the following steps:

- Application Submission: The owner of a shop or establishment must submit an application for registration to the local labour department within a specified period (usually 30 days) from the start of business operations.

- Form and Documents: The application must be submitted in the prescribed format, along with necessary documents such as proof of establishment address, identity proof of the owner, and details of employees.

- Inspection: In some cases, an inspection of the premises may be conducted by the labour inspector to verify the details provided in the application.

- Registration Certificate: Upon satisfactory verification, a registration certificate is issued to the owner. This certificate must be prominently displayed at the establishment.

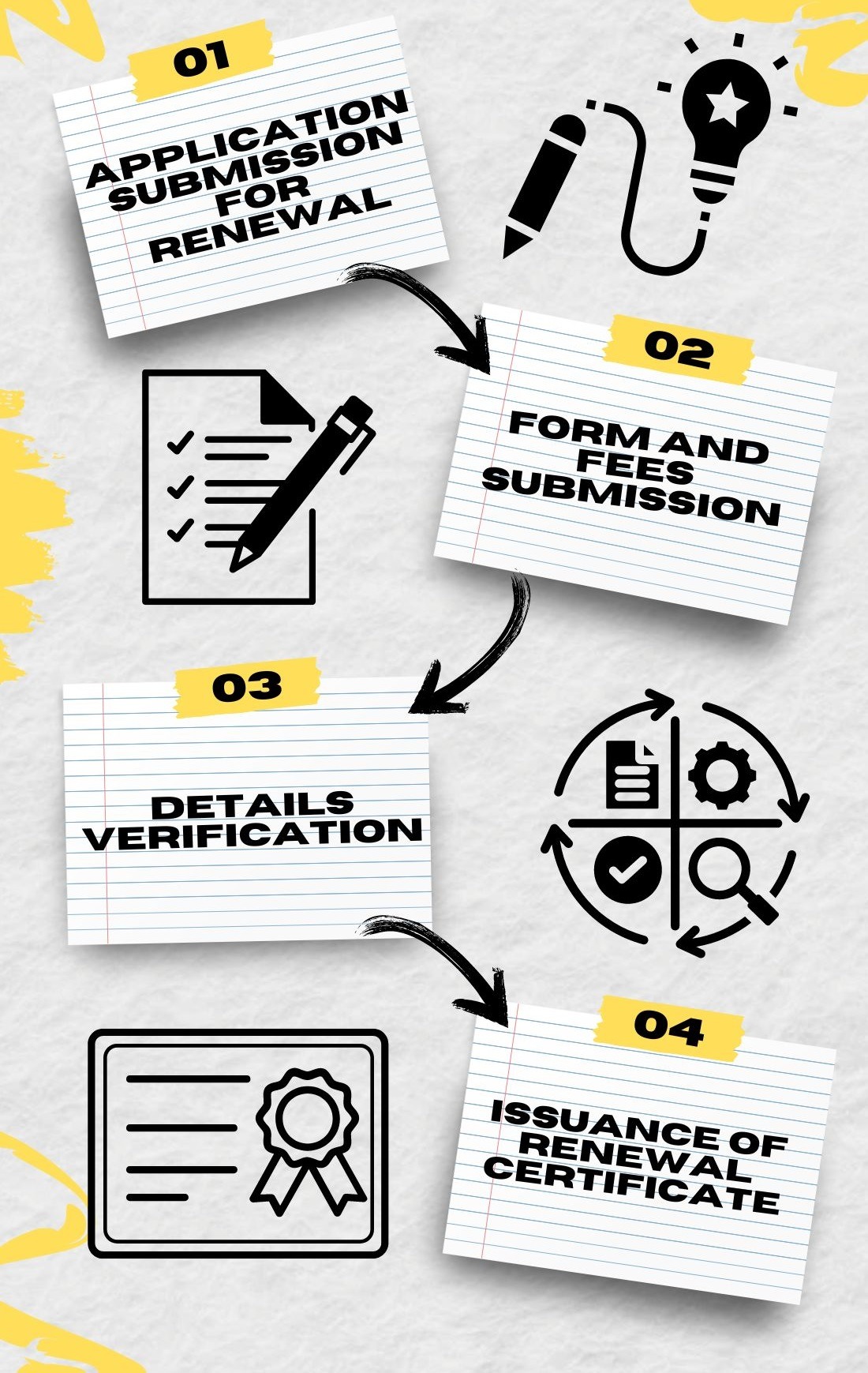

- Application for Renewal: The registration certificate must be renewed periodically, typically on an annual basis. The renewal application should be submitted before the expiry of the current registration.

- Form and Fees: The renewal application must be submitted in the prescribed format, along with the renewal fee and any required documents.

- Verification: The labour department may verify the details provided in the renewal application.

- Issuance of Renewal Certificate: Upon successful verification, a renewal certificate is issued, which should be displayed at the establishment.

Inspection and Compliance Requirements

The Shop and Establishment Act includes specific provisions for compliance and inspection to ensure that businesses adhere to labour laws and maintain fair working conditions. Here are the key aspects:

Inspection Requirements

Compliance Requirements:

The Shops and Establishments registration in Delhi NCR

The Shops and Establishments Act in Delhi, also known as the Delhi Shops and Establishments Act, is a state legislation aimed at regulating the working conditions of employees in shops, commercial establishments, residential hotels, restaurants, theaters, and other public amusement or entertainment places. The Act lays down provisions related to working hours, rest intervals, holidays, and other conditions of service.

Registration Process

- Any commercial establishment or shop employing one or more workers must register under the Delhi Shops and Establishments Act. This includes businesses like retail shops, offices, cafes, restaurants, coaching institutes licences and more.

- Building approval for retail shops, offices, cafes, restaurants, coaching institutes licences and more.

- Proof of establishment (lease agreement, property tax receipt, etc.)

- Identity proof of the owner (Aadhar card, passport, etc.)

- Address proof of the owner (electricity bill, Aadhar card, etc.)

- List of employees, if applicable Details of the establishment, including the nature of business and number of employees

- Application: The employer must apply for registration by submitting an online or offline application form to the Labour Department within 30 days of starting the business.

- Submission of Documents: Along with the application, the required documents must be submitted.

- Inspection: If necessary, an inspection may be conducted by the authorities to verify the information provided.

- Registration Certificate: Upon approval, a registration certificate will be issued, which must be displayed prominently at the establishment.

The registration certificate needs to be renewed periodically, usually annually or as specified. Any changes in the establishment, such as a change of address or ownership, must be reported to the Labour Department, and the registration certificate must be amended accordingly.

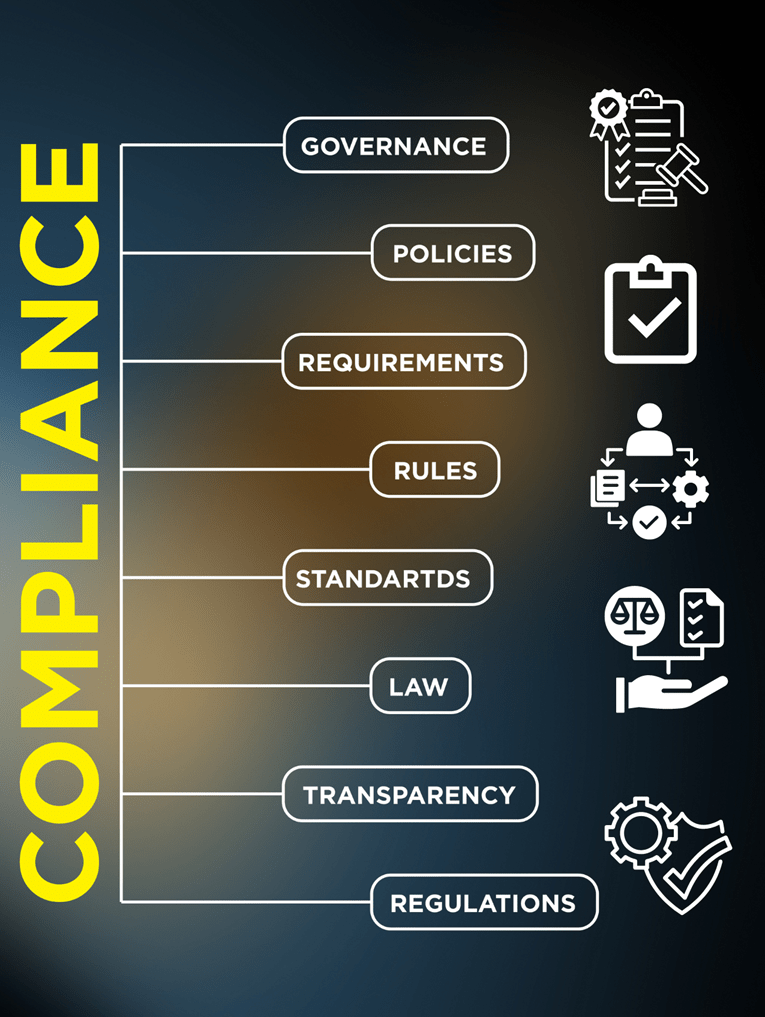

Compliance:

- Employers must comply with various provisions of the Act, including maintaining proper records of attendance, wages, and working hours.

- The Act also mandates the observance of certain holidays and ensures the welfare of employees through provisions related to leaves, overtime, and more.

Penalties: Non-compliance with the provisions of the Delhi Shops and Establishments Act may result in penalties, including fines and legal actions.

Contact Us for All Labour Law Compliance

Navigate labour laws compliance effortlessly with expert guidance. Stay updated on key regulations, ensure workplace compliance, Shop Act Registration Services and avoid legal risks. Discover essential tips for HR professionals and businesses.

The Shop and Establishment Act FAQs:

What is the process for cancellation of a Shop and Establishment license?

Answer: To cancel a Shop and Establishment license, business owners must submit a cancellation request to the local labour department, citing reasons like closure of business or relocation. Some states offer an online cancellation process.

What documents are needed for Shop and Establishment registration?

Answer: Documents for registration typically include business license, employee details, address proof, and identity proof of the owner. States may have specific documentation requirements, which can be verified through the state labour department.

How can businesses file grievances under The Shop and Establishment Act?

Answer: Businesses or employees can file grievances related to the Act with the local labour department or labour commissioner. Many states provide an online grievance filing option, ensuring that complaints are addressed promptly.

Is the Shop and Establishment Act different in each state?

Answer: Yes, each state has its own version of the Shop and Establishment Act, which may vary slightly in terms of working hours, registration process, leave policies, and other specifics. Employers must follow the Act specific to their state of operation.

What are the penalties for non-compliance with The Shop and Establishment Act?

Answer: Non-compliance with the Act can lead to penalties, including fines and legal actions. Failing to register, maintain records, or comply with work hour regulations are common violations that attract fines.

What are the record-keeping requirements under The Shop and Establishment Act?

Answer: Employers must maintain records related to employee attendance, wages, leave, working hours, and other statutory requirements. These records help ensure compliance with the Act and may be audited by labor inspectors.

Are there any exemptions under The Shop and Establishment Act?

Answer: Certain categories of employees, such as managerial staff, may be exempt from provisions related to working hours and overtime. Exemptions vary by state, so employers should check state-specific rules and conditions.

What are the employer obligations under The Shop and Establishment Act?

Answer: Sho p Establishment Consultants must maintain a safe and healthy workplace, keep proper records of employee details, wages, working hours, and leave. Compliance with regulations on work hours, leave policies, and wage payments is essential to avoid penalties.

What employee benefits are required under The Shop and Establishment Act?

Answer: The Act mandates employee benefits like paid leave, sick leave, maternity leave, and casual leave. Employees are also entitled to a safe working environment, specified working hours, and fair wages.

What is the procedure for renewing Shop and Establishment licenses?

Answer: To renew a Shop and Establishment license, business owners need to submit a renewal application before the expiry date. Renewal procedures and documentation vary by state, and many states now offer online renewal options.

What are the working hours and overtime rules under The Shop and Establishment Act?

Answer: The Act regulates working hours, including overtime rules, rest intervals, and weekly off days. Working hours are generally capped at 9 hours a day or 48 hours a week, with overtime pay required for additional hours worked.

Why is registration under The Shop and Establishment Act important?

Answer: Registration is mandatory for businesses, as it provides legal recognition and compliance with local labor laws. It helps businesses avoid penalties, ensures employee rights, and boosts credibility with customers and employees.

What is the process for Shop and Establishment registration?

Answer: To register under the Shop and Establishment Act, business owners must submit an application form, with details about the establishment and employees, to the local labor department. Many states now allow online registration through their official portals.

Who is covered under The Shop and Establishment Act?

Answer: The Act applies to employees working in shops, retail businesses, restaurants, theaters, hotels, service establishments, and similar businesses. Both full-time and part-time employees are covered to ensure fair treatment and workplace protection.

What is The Shop and Establishment Act?

Answer: The Shop and Establishment Act is a labor law governing the working conditions, hours, rest periods, and wages of employees in shops, commercial establishments, and other service providers. The Act ensures employee welfare by setting minimum standards for work environments and applies to both small and large businesses.