Compliance Audit & Risk Management Services

Our compliance audit consultants, Ensuring Seamless Legal Compliance Audit for Your Business

The Importance of Compliance Risk Audits: A Brief Overview

Labour law compliance audits are essential for organizations to ensure they are adhering to legal regulations, industry standards, and internal policies. These audits help identify areas of non-compliance that could lead to legal penalties, financial losses, or damage to a company’s reputation. By regularly conducting compliance audits, businesses can proactively address potential risks, improve operational efficiency, and maintain trust with stakeholders. Ultimately, compliance audits play a critical role in safeguarding an organization’s integrity and sustainability in a competitive and regulated environment.

Introduction to SANKHLA CONSULTANTS’ Expertise in Providing Compliance Audit Services

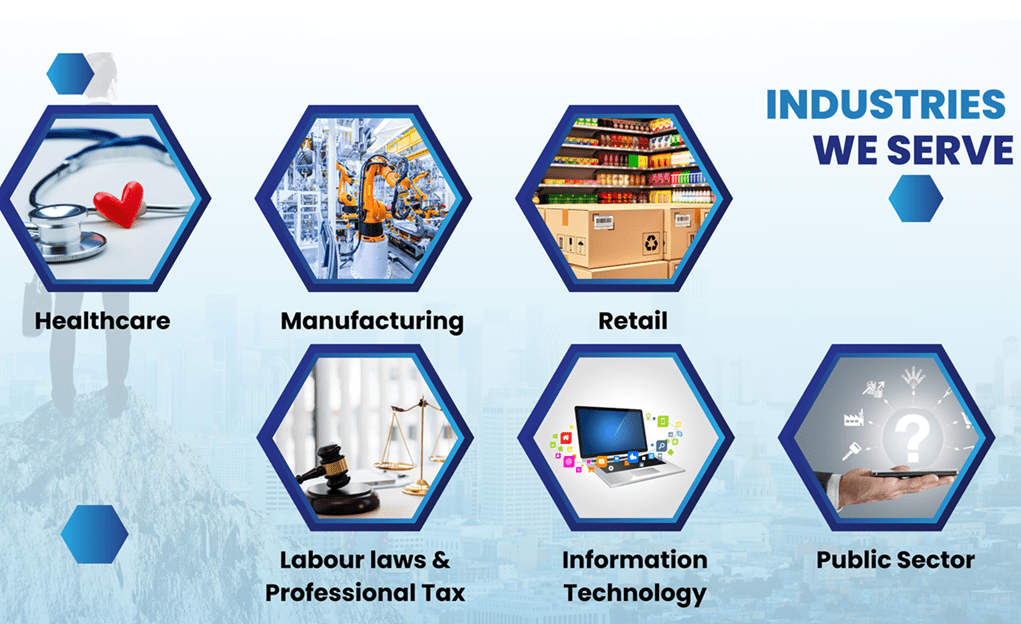

At SANKHLA CONSULTANTS, we are dedicated to delivering top-tier “governance risk and compliance” audit process services that empower businesses to stay ahead of regulatory requirements. With extensive experience across various industries, our team of experts meticulously examines your operations to ensure full compliance with relevant laws, regulations, and standards. We provide customized audit and compliance solutions that not only identify potential risks but also enhance your organization’s operational efficiency and regulatory standing. Trust SANKHLA CONSULTANTS to be your strategic partner in achieving and maintaining compliance excellence. Sankhla consultants are the best compliance auditors.

What is a Labour law Compliance Audit?

Definition and Purpose of Compliance Audits:

Compliance audits are systematic evaluations conducted to assess whether an organization adheres to legal regulations, industry standards, and internal policies. The primary purpose of these audits is to ensure that a company operates within the boundaries of the law and follows best practices relevant to its industry. In essence, compliance audits are crucial tools for maintaining organizational integrity, mitigating risks, and fostering a culture of accountability and transparency.

Compliance and audits serve several key purposes:

Risk Identification & Mitigation

By identifying areas of non-compliance, organizations can address potential risks before they result in legal penalties, financial losses, or reputational damage.

Operational Improvement

Audits help uncover inefficiencies and gaps in processes, enabling businesses to enhance their operations and ensure continuous improvement.

Regulatory Audit

Compliance audit companies confirm that an organization is meeting the legal requirements set by governing bodies, thus avoiding fines and legal action.

Stakeholder Assurance

Regular audits build trust among stakeholders, including customers, employees, and investors, by demonstrating the organization’s commitment to ethical practices and regulatory compliance.

How Compliance Audits Help Organizations Adhere to Legal, Regulatory, and Internal Policies

Compliance audits play a crucial role in helping organizations maintain adherence to legal audit process, compliance & regulatory, audit & risk, and internal policies. These audits systematically evaluate an organization’s processes, practices, and documentation to ensure they align with relevant laws, regulations, and standards. Here’s how they help:

Our Compliance Risk Audit Process

Risk management process: Understanding client needs and industry requirements.

At SANKHLA CONSULTANTS, our compliance audit process (risk control process) begins with a thorough Initial Consultation where we focus on understanding your specific needs and the unique regulatory requirements of your industry. During this phase, our experts engage closely with your team to gain a comprehensive understanding of your business operations, goals, and compliance challenges. This deep dive allows us to tailor our audit approach to align with your organizational objectives, ensuring that we address the most critical areas of concern. By understanding your industry’s regulatory audit landscape, we can provide precise and actionable insights that not only meet but exceed compliance expectations.

Compliance and risk management: Identifying potential areas of non-compliance.

Our Risk Assessment process is a crucial step in the compliance audit journey at SANKHLA CONSULTANTS. During this phase, we meticulously examine your organization’s operations, policies, and procedures to identify potential areas of non-compliance. By analyzing your current practices against industry regulations and internal standards, we pinpoint vulnerabilities that could expose your business to legal and financial risks. Our team uses advanced assessment tools and methodologies to ensure a comprehensive evaluation, enabling us to provide you with a clear understanding of where your organization stands and what actions are needed to achieve full compliance. This proactive approach not only mitigates risks but also strengthens your overall compliance framework.

Developing a customized audit plan tailored to the organization’s specific needs.

At SANKHLA CONSULTANTS, our Audit Planning process is designed to create a tailored audit plan that aligns perfectly with your organization’s specific needs and objectives. We begin by analyzing the insights gained during the initial consultation and risk assessment phases to ensure that our audit strategy addresses the most critical areas of your operations. Our team carefully considers your industry’s regulatory landscape, internal policies, and unique challenges to develop a comprehensive audit plan that is both thorough and efficient. This customized approach ensures that our audit not only meets regulatory requirements but also provides actionable recommendations to enhance your organization’s compliance posture and operational effectiveness.

Conducting a thorough review of the organization’s practices, procedures, and documentation.

The Audit Execution process at SANKHLA CONSULTANTS is where our expertise truly comes into play. During this phase, we conduct a meticulous review of your organization’s practices, procedures, and documentation to ensure compliance with legal, regulatory, and internal standards. Our team of experienced auditors delves into every aspect of your operations, scrutinizing records, workflows, and control mechanisms to identify any deviations or areas of concern. This comprehensive review is designed not only to detect non-compliance but also to uncover inefficiencies and risks that could impact your business. By providing a detailed and accurate assessment, we equip you with the insights needed to make informed decisions and implement effective corrective actions.

Providing detailed audit reports with findings, risks, and recommendations.

In the Reporting & Analysis phase of our compliance audit process at SANKHLA CONSULTANTS, we compile all the data and insights gathered during the audit into a comprehensive and detailed report. This report presents a clear picture of your organization’s compliance status, highlighting key findings, identified risks, and areas requiring attention. Our analysis goes beyond just identifying issues; we provide practical, actionable recommendations to help you address non-compliance and mitigate potential risks. Our reports are designed to be both informative and easy to understand, ensuring that your management team has the necessary insights to make strategic decisions and implement corrective measures effectively.

Assisting with the implementation of corrective actions and continuous monitoring

At SANKHLA CONSULTANTS, our commitment to your compliance doesn’t end with the audit report. In our Follow-up & Support process, we work closely with your team to assist in the implementation of corrective actions recommended during the audit. We provide ongoing guidance and support to ensure that these measures are effectively integrated into your operations. Additionally, we offer continuous monitoring services to track the progress of these actions and make any necessary adjustments. This proactive approach helps maintain compliance over the long term, reduces the risk of future non-compliance, and ensures that your organization stays aligned with regulatory standards and best practices.

Types of Compliance Risk Audits We Offer

| Types of Compliance Audits | We Offer |

|---|---|

| Regulatory Compliance Audits | Ensuring adherence to industry-specific regulations (e.g., labour laws, environmental regulations). |

| Internal Compliance Audits | Assessing compliance with internal policies and procedures. |

| Financial Compliance Audits | Verifying compliance with financial regulations and standards. |

| Health & Safety Compliance Audits | Ensuring workplace safety standards are met. |

| Data Protection & Privacy Audits | Ensuring adherence to data protection regulations, such as GDPR. |

Statutory compliance checklist-

A Statutory Compliance Checklist ensures that businesses adhere to various labour, tax, and regulatory laws. The checklist helps organizations stay compliant with statutory regulations, avoiding legal penalties and maintaining a good reputation. Below is a typical statutory compliance checklist:

Internal audit for HR department:

HR department internal audit is essential for ensuring compliance with employment laws, company policies, and best practices. This typically includes verifying employee records, reviewing payroll processes, assessing adherence to labour laws, and ensuring proper documentation of performance evaluations, training programs, payroll compliance audit and other Internal audit compliance for HR department. By conducting regular audits using a comprehensive HR checklist, organizations can identify potential issues, improve operational efficiency, and maintain a compliant and well-managed workforce. This proactive approach not only safeguards against legal risks but also enhances overall employee satisfaction and organizational performance.

Internal audit checklist for HR department

Benefits of Our Compliance Audit Services

Reputation Management

Maintaining a positive reputation by adhering to industry standards & regulations.

Legal Protection

Minimizing the risk of penalties and legal action due to non-compliance.

Risk Mitigation

Identifying and addressing potential risks before they lead to legal issues.

Enhanced Efficiency

Improving organizational processes and reducing inefficiencies.

Our Happy Clients

Labour laws Compliance Audit Guidelines:-

A risk audit compliance ensures that a company or organization adheres to the laws, regulations, guidelines, and standards applicable to its business. It helps mitigate risks, avoid penalties, and maintain legal and ethical standards. Below is a comprehensive guide on conducting compliance audits:

Compliance Audit FAQs:-

What is compliance audit?

Compliance audit is a systematic review of an organization’s adherence to regulatory standards, internal policies, and legal requirements. Conducted by internal or external auditors, this audit ensures that a company follows applicable laws, regulations, and industry standards, mitigating risks and avoiding penalties.

Key aspects of compliance audits include:

- Regulatory Adherence: Verifying that the organization complies with laws and regulations specific to its industry.

- Internal Policies: Ensuring that internal procedures and controls are being followed.

- Risk Management consulting: Identifying areas of non-compliance and recommending corrective actions.

- Documentation Review: Examining records, reports, and other documentation to ensure proper compliance.

A well-conducted compliance audit helps organizations maintain operational integrity, safeguard their reputation, and prevent legal issues. For businesses, it’s crucial for staying compliant with various regulations, such as financial reporting, environmental laws, and employment practices.

What is compliance governance?

Compliance governance refers to the system, processes, and structures that ensure an organization adheres to laws, regulations, policies, and ethical standards. It involves establishing a framework to manage compliance risks, monitor regulatory requirements, and implement procedures to ensure that the company operates within legal boundaries and maintains accountability.

Key aspects of governance risk management compliance include:

- Policy Creation & Implementation: Developing and enforcing policies that align with legal regulations and ethical standards.

- Risk Management: Identifying compliance risks and ensuring appropriate controls are in place.

- Monitoring & Auditing: Continuously tracking adherence to compliance requirements and conducting audits to assess effectiveness.

- Training & Awareness: Educating employees about legal obligations and ethical practices.

- Reporting & Accountability: Ensuring transparency and accountability in compliance-related matters by establishing a clear reporting structure.

Good governance and risk compliance system helps businesses minimize risks, avoid legal penalties, and build trust with stakeholders. It’s an essential part of corporate governance.

What is audit procedure?

Audit Procedure refers to the systematic steps and methods used by auditors to assess an organization’s financial statements, operations, and compliance with regulations. This process ensures accuracy, integrity, and adherence to standards. Here’s a breakdown of the audit procedure:

- Planning and Preparation: Auditors gather information about the organization, understand its operations, and define the scope of the audit. This includes identifying key areas of risk and establishing an audit plan.

- Risk Assessment: Auditors assess the risks associated with the organization’s financial reporting and internal controls. This involves evaluating the likelihood of misstatements or fraud.

- Internal Controls Review: Evaluating the effectiveness of the organization’s internal controls and procedures to prevent and detect errors or fraud.

- Substantive Testing: Conducting detailed tests on transactions, balances, and other financial data to verify accuracy and completeness. This includes sampling and examining supporting documents.

- Analytical Procedures: Analyzing financial trends and relationships to identify any unusual patterns or discrepancies.

- Documentation: Auditors document their findings, evidence, and the audit process. This includes preparing working papers that support the audit conclusions.

- Reporting: Preparing the audit report, which summarizes findings, includes an opinion on the financial statements, and provides recommendations for improvements.

- Follow-up: Reviewing the implementation of audit recommendations and ensuring that corrective actions have been taken.

How to write a compliance audit report?

Writing a compliance audit report involves documenting the findings of an audit to ensure that an organization adheres to laws, regulations, and internal policies. Here’s a step-by-step guide to crafting an effective compliance audit reports:

- Title Page: Include the report title, the name of the organization, the audit period, and the date of the report.

- Executive Summary: Provide a brief overview of the audit objectives, scope, key findings, and recommendations. This section should give a high-level summary for quick understanding.

- Introduction: Describe the purpose of the audit, the scope, and the methodology used. This section sets the context for the findings.

- Findings: Detail the specific compliance issues discovered during the audit. Include evidence and examples to support each finding. This section should be clear and concise.

- Analysis: Discuss the implications of the findings and how they impact the organization’s compliance status. Analyze the root causes and potential risks.

- Recommendations: Provide actionable recommendations to address the issues identified. Ensure that these suggestions are practical and align with compliance requirements.

- Action Plan: Outline the steps that the organization should take to implement the recommendations. Include timelines and responsible parties for each action.

- Conclusion: Summarize the overall compliance status and the effectiveness of the organization’s compliance program.

- Appendices: Include any supplementary information, such as detailed evidence, charts, or supplementary documentation that supports the audit findings.

- Sign-off: Provide space for the auditor’s signature and date to validate the report.

What is compliance in audit?

Compliance in audit refers to the adherence to laws, regulations, policies, and standards that an organization must follow. It ensures that an organization’s operations and practices align with legal and regulatory requirements, internal policies, and industry standards.

Definition: Compliance in audit involves evaluating whether an organization meets established legal and regulatory standards. Auditors review practices, policies, and documentation to verify adherence to applicable laws and regulations.

Purpose: The primary goal of compliance auditing is to ensure that the organization is operating within the boundaries set by external regulators and internal policies. This helps in mitigating risks, avoiding legal penalties, and ensuring operational efficiency.

Compliance consulting process: Compliance audits typically include reviewing documentation, conducting interviews, and testing controls to assess adherence to specific regulations and standards. Auditors provide a report detailing findings, any deviations, and recommendations for improvement. ‘

Benefits of compliance management: Effective compliance audits help organizations identify and address non-compliance issues, improve internal controls, and enhance overall governance and compliance. It also helps in building trust with stakeholders and avoiding legal issues.

What are Common Forms and Documents for Compliance Audits ?

- Employee Registers (Form 6) for labour law audits.

- ESIC and PF Contribution forms for employee welfare audits.

- Licenses and Permits for environmental and operational audits.

- Tax Returns and financial records for financial audits

Compliance Audit Checklist for Labour Law Compliance:

- Employee Documentation:

- Maintain proper employee registers (attendance, wages, etc.).

- Verify employee contracts are compliant with applicable labour laws.

- Ensure PF (Provident Fund) and ESI (Employee State Insurance) registration.

- Check if minimum wages are paid as per law.

- Ensure compliance with overtime and working hours regulations.

- Welfare and Safety:

- Verify compliance with the Factories Act (if applicable) for workplace safety.

- Check compliance with maternity benefits and gratuity laws.

- Ensure compliance with leave policies (paid leave, sick leave, etc.).

- Adhere to sexual harassment prevention regulations (e.g., POSH Act).

Financial Compliance:

- Taxation:

- Ensure timely filing of GST returns and payment of taxes.

- Verify accurate TDS (Tax Deducted at Source) deductions and deposits.

- Check that professional tax is deducted as per state laws.

- Statutory Dues:

- Verify that Provident Fund contributions are made timely.

- Ensure accurate ESI contributions and adherence to contribution limits.

- Cross-check all challans and payment receipts for statutory dues.

- Financial Reporting:

- Ensure financial records are in compliance with accounting standards.

- Verify that all financial statements are audited as per legal requirements.

Contact Us Today

Office Address: Plot No. 1984, LGF, Sec-45, Gurgaon, 122003, Haryana

Email: marketing@sankhlaco.com

Contact: +91 7809900200, +124-4211707, 4266706