Ensuring timely and accurate compliance with labour laws is one of the most crucial responsibilities for any organization in India. With a complex framework of central and state-specific labour legislations, HR and compliance professionals often face challenges in tracking due dates for returns, payments, and submissions.

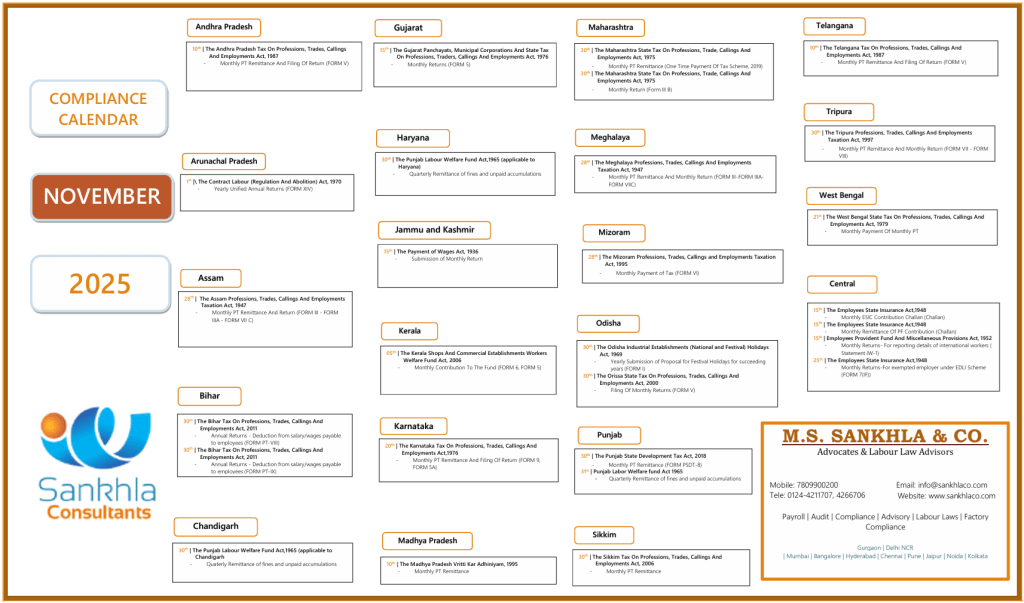

To make this task easier, Sankhla Corporate Services Pvt. Ltd. presents the Labour Laws Compliance Calendar for November 2025, covering all key statutory compliances applicable across various states in India.

Why Labour Law Compliance Matters

Non-compliance with labour laws can lead to:

- Penalties, fines, and interest on delayed payments

- Legal notices or inspections from authorities

- Loss of business credibility and reputation

Following a monthly compliance calendar ensures your organization remains legally sound, audit-ready, and employee-trustworthy.

Key Compliances for November 2025

Below are some important statutory deadlines and acts applicable during November 2025 across different states:

Central Compliance

- 15th November – Payment and filing of Provident Fund (PF) contribution under the Employees’ Provident Fund and Miscellaneous Provisions Act, 1952

- 15th November – Deposit of ESIC contribution under the Employees’ State Insurance Act, 1948

- 25th November – Filing of EDLI exemption returns (Form 7(IF)) for exempted employers

State-wise Major Compliances

Andhra Pradesh

- 10th November – Monthly remittance and filing under the Andhra Pradesh Tax on Professions, Trades, Callings and Employments Act, 1987 (Form V)

Karnataka

- 20th November – Monthly PT remittance and filing (Form 9, Form 5A) under the Karnataka Tax on Professions, Trades, Callings and Employments Act, 1976

Maharashtra

- 30th November – PT monthly remittance and return (Form III B) under the Maharashtra State Tax on Professions, Trade, Callings and Employments Act, 1975

Punjab & Haryana

- 30th November – Quarterly remittance of fines and unpaid accumulations under the Punjab Labour Welfare Fund Act, 1965 (also applicable to Haryana and Chandigarh)

Odisha

- 30th November – Yearly submission of festival holiday proposals under the Odisha Industrial Establishments (National and Festival) Holidays Act, 1969 (Form I)

Kerala

- 5th November – Monthly contribution to the Kerala Shops and Commercial Establishments Workers Welfare Fund (Form 5, Form 6)

…and several others across Assam, Bihar, Mizoram, Meghalaya, Tripura, Telangana, Sikkim, and more.

How This Calendar Helps HR & Compliance Teams

This monthly compliance calendar:

- Provides state-wise and act-wise due dates at a glance

- Helps organizations avoid penalties and ensure timely submission

- Acts as a ready reckoner for HR, payroll, and compliance officers

Whether you manage compliance in one state or across multiple locations, having a structured calendar simplifies your monthly statutory planning.

About Sankhla Corporate Services Pvt. Ltd.

At Sankhla Corporate Services Pvt. Ltd., we specialize in Labour Law Compliance, Statutory Register Maintenance, Audit & Advisory Services for corporates across India.

Our team of experts ensures your organization remains compliant with all applicable labour laws — from PF, ESIC, LWF, and Professional Tax to Shops & Establishment and Factory Act compliances.

Staying compliant is not just about meeting deadlines — it’s about building a foundation of trust, transparency, and accountability. With the Labour Laws Compliance Calendar – November 2025, you can stay ahead of your statutory obligations and focus on what truly matters — growing your business.