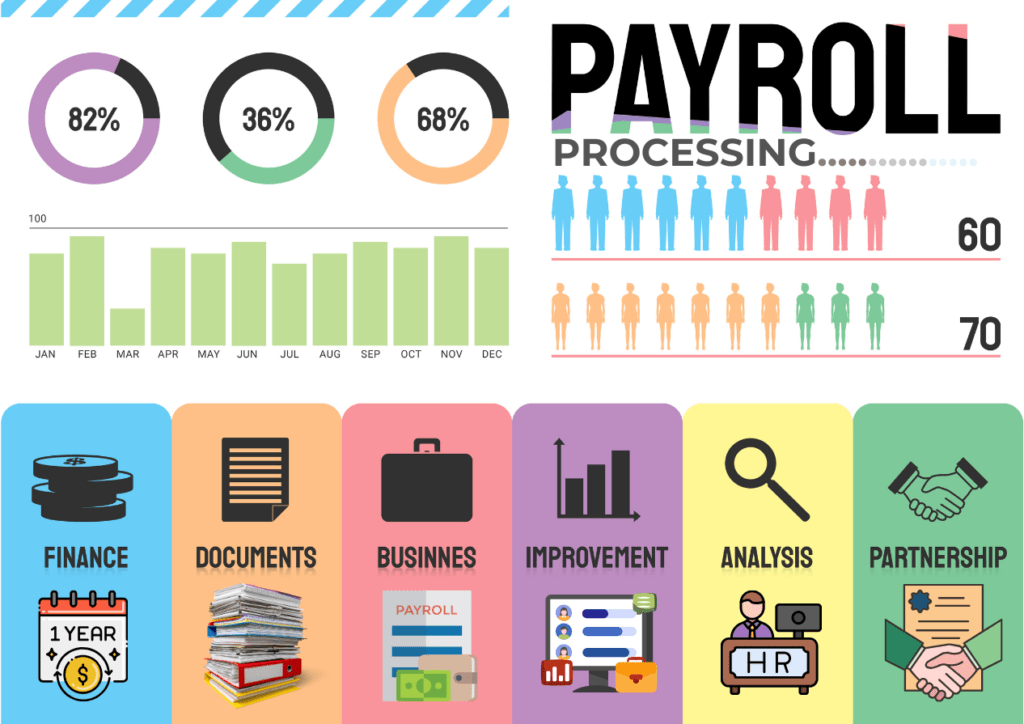

PAYROLL PROCESSING SERVICES

Our Payroll Compliance Services help close any gaps in compliance with employees’ remuneration rights and ensure payroll operations follow all applicable regulations.

About Outsource Payroll and Labour laws Compliance Services

States and federal governments have their own labour rules that businesses must abide by. Companies must stay current on all labour laws in India in order to handle statutory compliance. Companies are also required to follow them. A corporation may face severe legal repercussions as well as financial penalties and fines for failing to comply with these regulations.

For this reason, every business spends a significant sum of money, time, and effort in order to comply with regulations ranging from professional taxes to provident funds and gratuities, among others. The business consults with specialists in tax and labour law to assist with this.

For every organisation, payroll is an essential function. Payroll data handling requires close attention to detail and caution because any mistakes can have detrimental effects. For payroll outsourcing firm and HR, processing payroll and other labour compliance requirements can be taxing. Regulations and compliance, employee welfare, and onboarding are all included.

- Being aware of every area of a business’s operations has grown increasingly difficult due to the significant growth in complexity of doing business.

- We provide associated services to help the payroll and compliance HR teams to make sure that the client can conveniently get all of their solutions from one location.

- The monthly payroll process begins upon receipt of information on new recruits, resignees, and any modifications to salary information.

- Following payroll, all required statutory filings and reimbursements must be completed. We further assist with licence renewals and fulfilling labour law requirements.

- Making payroll processing compliant with statutory audits requires a significant investment of time, finances, and resources for your organisation.

Who Requires Services for Payroll in India?

Any organisation that wants to insure compliance with the many payroll-related laws and regulations must use payroll management compliance services. This covers businesses of all sizes in a range of sectors, including manufacturing, healthcare, IT, and hospitality.

These services help businesses abide by regulations pertaining to employee payroll systems.

Take Compliance Expertise Advantage

Payroll Outsourcing services Can Help in:

Why Do You Require Services for Payroll Compliance?

Moral Obligation

Employers are morally obligated to ensure that employees receive the compensation and benefits they deserve. Payroll management compliance services assist businesses in fulfilling these responsibilities and enhancing their reputation and fame.

Time Saving

Payroll system compliance services free up organizations to focus on their core business operations by handling all process payroll compliance-related tasks. Compliance payroll can be time-consuming, especially for companies with large disciplined workforces.

Cost Savings

Charges, Legal penalties, fines, and reputational harm may arise from breaking payroll-related laws and regulations. Payroll system Compliance Services assist companies in avoiding these expenses so they may concentrate on their main company operations compliances.

Risk Management

Non-compliance with payroll-related laws and regulations can result in legal and financial risks. Payroll processing compliance services help to manage risks by making sure that all applicable labour rules and regulations are followed.

Categorised Services Offering

- Universal Account Number (UAN) generation in EPF

- Employee’s UAN & I.P no. for all respective PF

- Coordination assistance for obtaining ESI and EPF benefits

- Assistance with employee PF account transfers and withdrawals

- Provide monthly Challan creation for EPF

- Handle employer changes and adjust employee UAN numbers

- Maintain liaison with the PF department

- Helping workers to receive pension benefits upon retirement

- Preparing and submitting documents to PF

- Managing PF compliances & payroll for employees

- Assisting employees with PF account settlements

- Timely statutory contribution remittance

- Get or change EPF codes

- Provide legal advice on PF related issues

- Help staff members with pension claims, withdrawals, and transfers in and out

- Multi state payroll tax compliance

- Global payroll compliance

- Insured Person Number (IPN) Generation in ESI

- Provide legal advice ESI-related issues

- ESI code Generation in ESI

- Get or change ESI codes

- Coordination assistance for obtaining ESI benefits

- Provide monthly Challan creation for ESI

- Maintain liaison with the ESI department.

- Things to check before your EPF & ESI audit/inspection

- Preparing and submitting documents employees state insurance act (ESI)

- Assistance with ESI benefits (medical and accident claims, etc.)

- Help staff members with pension claims, withdrawals, and transfers in and out.

- Support coordination for ESI compliances connected to accidents

- Acquire or modify EPT codes

- Compiling and submitting statutory returns under EPT

- Sending in statutory payments under EPT

- Sending in PT and LWF on a quarterly basis

- PT and LWF compliance maintenance

Other Payroll / HR Services

- The management of exits

- All Requirements compliances managing

- Consulting on compensation and benefits

- Planning for taxes and support for TDS Information about any changes to legislation

- Work together with the client to manage statutory authority inspections

- Enabling workers to move accounts online between companies

- Enabling workers to get EDLI benefits based on the applicability

- Arrangement of inspections and notifications in conjunction with the authorities

- Registration, renewal, or modification of any kind in accordance with the many applicable labour law Acts

- Timely submission of monthly, quarterly, half-yearly, and annual returns in accordance with the deadlines stipulated by law

- Calculating expat salaries

- The drafting of HR policies

- Employee benefits and liabilities

- Creating monthly statutory challans

- Error free professional tax services

- The management of performance

- The management of attendance and leaves

- The creation of monthly statutory challans

- Managing inspections on the client’s behalf

- Employee assistance with KYC updates via the portal

- Support in coordinating compliances connected to accidents

- Upholding the labour laws act’s records, returns, and registers

- Enabling workers to transfer their accounts electronically across companies

- Creating and updating policies based on current roles and rules

Things to Consider When Looking For Payroll and Labour laws Compliance Services in Gurgaon

Below Labour Laws Acts are most important to you:

- The 1965 Bonus Payment Act

- Requires annual bonuses for workers who put in at least 30 days of labour, based on compensation and business profitability.

- Labour welfare Act

- Improves social security benefits and working conditions for workers in particular industries under state supervision.

- The 1972 Payment of gratuity Act

- Requires gratuity payments in businesses or core business with ten or more workers, including non-profit organisations, medical facilities, and educational institutions.

- Offered payment of gratuity act

- The Employees Provident Fund and Miscellaneous Provision Act (EPF Act 1952)

- For businesses with 20 or more employees, there is a requirement for employer and employee contributions to social welfare.

- POSH ACT 2013:

- The Act of 2013 that addresses the prevention, prohibition, and redress of sexual harassment of women in the workplace.

- The 1936 Payment of wages Act

- Ensures companies pay wages on time, with flexibility in the frequency and form of payments.

- The 1948 Minimum wages Act

- Establishes minimum wage rates that vary by state and industry in order to avoid labour exploitation.

- The 1948 Employees State Insurance Act

- Medical facilities for oneself and dependents are a benefit available to employees under the plan. Additionally, if certain circumstances lead to a loss of earnings or earning ability, they are also entitled to monetary rewards. For their confinement, the insured women are entitled to maternity benefits.

- The 1961 Maternity benefits Act:

- Provides women who work for companies with more than ten workers maternity leave and benefits.

- TDS, or tax deducted at source

- For all workers within the Income Tax Slab, indirect tax collection via employer deduction prior to salary distribution.

- Error free professional tax services for employer

Managed Payroll Services Available:

Every organisation must follow the guidelines for PT, LWF, ESI, and EPF remittances.

Payroll Management Consultants can assist with the requirements for post-payroll tax compliance by addressing the scope of work payroll listed below.

Payroll Process

We offer to provide accurate monthly payroll processing to your employees as part of our all-inclusive payroll services. Managing allowances, special payments, one-time payments, attendance, and F&F settlements are all included in this. Another important component of payroll is the deduction, which can be difficult for businesses to handle because it varies depending on factors like location and kind of employment.

Tax Advice services

Employers and employees are served by tax advising services. It also assists employees and employers in successfully managing their spending, reducing tax liabilities, and maximising tax benefits. We hold an Income Tax Declaration event at the start of the fiscal year, and a Proof of Investment session in December or January.

Analytics and Reporting

An effective reporting and analytics system for payroll management helps monitor the general pattern of payroll expenses, identifying potential discrepancies, providing strategies to reduce costs, and supporting workforce planning.

Employment Services

- Payroll Staffing Services

- Step by step payroll process

- Employee handbook

- EPF and ESI Registration

- Salary structure

- HR manuals

COMPANY PAYROLL MANAGEMENT TASK ACTIVITIES

The following are a few tasks completed during the payroll process compliance run: Payroll applications

Payroll processing and compliance FAQs:-

What is statutory compliance?

Statutory compliance refers to the adherence to laws, regulations, and guidelines set by governmental bodies. In the context of business operations, it involves:

- Following Legal Requirements: Ensuring that all business practices comply with local, state, and national laws, such as labor laws, tax regulations, and safety standards.

- Regulatory Compliance: Meeting industry-specific regulations, including environmental regulations, health and safety standards, and financial reporting requirements.

- Employee Compliance: Adhering to employment laws related to wages, benefits, working hours, and workplace safety.

- Tax Compliance: Accurately filing taxes, including income tax, VAT, and other applicable taxes, and maintaining proper records.

- Documentation and Reporting: Maintaining proper documentation and submitting required reports to government agencies to demonstrate adherence to statutory requirements.

Ensuring statutory compliance helps businesses avoid legal penalties, fosters operational efficiency, and maintains a positive reputation.

What is third party payroll?

Third-party payroll refers to the outsourcing of payroll management and processing tasks to an external service provider by a payroll firm. This approach involves:

- Payroll Processing: A third-party payroll provider handles all aspects of payroll, including calculating wages, processing payments, and distributing salaries.

- Tax Compliance: The service provider manages payroll taxes, including deductions for income tax, Social Security, and Medicare, and ensures timely tax filings.

- Benefits Administration: Third-party pay roll system services often include management of employee benefits such as health insurance, retirement contributions, and leave benefits.

- Regulatory Compliance: Ensuring compliance with labor laws, wage regulations, and employment standards, reducing the risk of legal issues for the business.

- Reporting and Record Keeping: Providing detailed payroll reports, maintaining records, and offering insights into payroll expenses.

Using third-party payroll services allows businesses to streamline payroll operations, reduce administrative overhead, and ensure accurate and compliant payroll management while focusing on their core business activities.

How to calculate payroll?

Calculating payroll involves determining employee earnings and deductions accurately to ensure correct payment. Here’s how to calculate payroll:

Payroll Package:

- Determine Gross Pay: Calculate the total earnings for each employee before deductions. This includes regular wages, overtime, bonuses, and commissions. Use the formula:

[ \text{Gross Pay} = (\text{Hourly Rate} \times \text{Hours Worked}) + \text{Overtime} + \text{Bonuses} ] - Calculate Deductions: Deduct applicable taxes and other withholdings from gross pay. Common deductions include:

- Income Tax: Based on the employee’s tax bracket and withholding allowances.

- Social Security: A percentage of gross pay, as mandated by law.

- Medicare: Another percentage of gross pay.

- Retirement Contributions: Employee contributions to retirement plans like 401(k) or PF.

- Health Insurance Premiums: Employee’s share of health insurance costs.

- Calculate Net Pay: Subtract total deductions from gross pay to determine the net pay.

[ \text{Net Pay} = \text{Gross Pay} – \text{Total Deductions} ] - Verify Compliance: Ensure all calculations comply with local, state, and federal regulations, including minimum wage laws and overtime rules.

- Generate Payroll Reports: Create detailed reports for payroll records, tax filings, and compliance audits.

Accurate payroll calculation is crucial for maintaining employee satisfaction, ensuring legal compliance, and avoiding financial penalties.

What is payroll company ?

Payroll companies are specialized payroll service providers these managed and processed employee payroll functions for businesses. Services provided by pay roll companies typically include:

- Payroll Processing: Calculating and distributing employee salaries, wages, and bonuses, ensuring accuracy in payments.

- Tax Calculations and Filing: Handling deductions for income tax, Social Security, Medicare, and other statutory taxes, and filing tax returns on behalf of the business.

- Benefits Administration: Managing employee benefits such as health insurance, retirement plans, and paid time off.

- Compliance Management: Ensuring compliance with labour laws, wage regulations, and other legal requirements, including maintaining necessary documentation.

- Reporting and Record Keeping: Generating payroll reports, maintaining records, and providing insights into payroll expenses and trends.

By outsourcing payroll functions to a payroll company, businesses can ensure accurate and timely process payroll, reduce administrative burdens, and focus on core business activities while staying compliant with regulatory requirements.

What is payroll process in HR?

The payroll process in HR refers to the systematic procedure for calculating and distributing employee salaries, wages, bonuses, and deductions. It ensures that employees are compensated accurately and on time while complying with applicable laws and regulations. Here’s a breakdown of the payroll system process in HR, focusing on key components and high search volume keywords.

- Employee Data Collection

- Gathering employee information, including personal details, salary structure, and tax information.

- Maintaining up-to-date records in the HR management system.

- Time and Attendance Tracking

- Recording employee working hours, overtime, leaves, and absences.

- Utilizing time-tracking software or manual timesheets for accuracy.

- Salary Calculation

- Determining gross pay based on hourly rates or salaries.

- Calculating deductions such as taxes, EPF, ESI, and professional tax.

- Assessing any bonuses or incentives based on performance metrics.

- Deductions and Benefits

- Ensuring compliance with statutory deductions required by law.

- Managing voluntary deductions such as health insurance or retirement contributions.

- Payroll Processing work: Work payroll

- Running payroll calculations through automated systems or payroll software.

- Reviewing calculations for accuracy and compliance with labor laws.

- Disbursement of Payments

- Processing direct deposits to employees’ bank accounts or issuing checks.

- Ensuring timely payment according to the payroll schedule.

- Payroll Reporting

- Generating payroll reports for internal use and statutory compliance.

- Filing necessary returns with tax authorities and maintaining compliance records.

- Audit and Reconciliation

- Conducting regular audits of payroll system records to ensure accuracy.

- Reconciling payroll data with financial records for transparency.

What is statutory compliance in HR?

Statutory compliance in HR refers to the adherence to labour laws and regulations that govern employment practices and employee rights. It includes:

- Adhering to Labor Laws: Ensuring compliance with laws related to wages, working hours, overtime, and employment conditions as per regulations like the Minimum Wages Act and the Factories Act.

- Employee Benefits: Implementing statutory benefits such as Provident Fund (PF), Employee State Insurance (ESI), and Maternity Leave as mandated by respective regulations.

- Tax Compliance: Managing and remitting taxes on employee salaries, including Professional Tax and Income Tax deductions, as per the Income Tax Act.

- Health and Safety: Complying with health and safety regulations to provide a safe working environment, as required by the Occupational Safety and Health Act.

- Record Keeping and Reporting: Maintaining accurate records of employee details, compliance documentation, and submitting necessary reports to regulatory authorities.

Ensuring statutory compliance in HR helps organizations avoid legal issues, promotes fair labour practices, and contributes to overall operational efficiency.

What is payroll management process?

The payroll management process involves the systematic handling of employee compensation, including salaries, wages, bonuses, and deductions. It ensures that employees are paid accurately and on time while adhering to legal requirements. Here’s an overview of the key components of the payroll management process, focusing on high search volume keywords.

- Employee Information Collection

- Gather essential data, such as personal details, tax information, and employment contracts.

- Maintain accurate records in the HR management system.

- Time and Attendance Tracking

- Record employee work hours, overtime, leaves, and absences.

- Use time-tracking software or timesheets to ensure precise data.

- Salary Calculation

- Determine gross pay based on hourly rates or salaries.

- Calculate deductions for taxes, EPF (Employee Provident Fund), ESI (Employee State Insurance), and professional tax.

- Include bonuses and incentives based on performance metrics.

- Deductions Management

- Ensure compliance with mandatory deductions as per labor laws.

- Manage voluntary deductions like health insurance or retirement contributions.

- Payroll work Processing

- Execute payroll calculations through automated payroll software.

- Review for accuracy and compliance with applicable regulations.

- Disbursement of Payments

- Process direct deposits into employees’ bank accounts or issue physical checks.

- Ensure timely payment according to the established payroll schedule.

- Payroll Reporting

- Generate payroll reports for internal analysis and compliance purposes.

- File necessary returns with tax authorities and maintain comprehensive records.

- Audit and Reconciliation

- Conduct regular audits of payroll records to ensure accuracy and compliance.

- Reconcile payroll data with financial statements for transparency.

Define payroll?

Payroll refers to the process of managing the financial records of employees’ salaries, wages, bonuses, net pay, and deductions. It includes calculating the total earnings of employees, deducting taxes and other statutory withholdings like provident fund and insurance, and ensuring timely payment. Company payroll management is a crucial function for businesses to comply with tax laws, maintain employee satisfaction, and ensure accurate compensation distribution with payroll outsourcing companies in India.