In a landmark move, the 56th GST Council Meeting on September 3, 2025, approved sweeping reforms under India’s indirect tax regime. After 10.5 hours of deliberation, the Council cleared GST 2.0, marking the biggest tax reform since GST’s launch in 2017.

The new structure simplifies slabs, reduces the burden on households, and improves ease of doing business through automation and faster compliance. According to Finance Minister Nirmala Sitharaman, the revised rates (except for tobacco products) will come into force from September 22, 2025, the first day of Navratri.

Key Highlights of GST 2.0

- Simplified Two-Slab Structure: 5% and 18%

- 40% Demerit Rate: Reserved for luxury, sin, and demerit goods

- Big Relief for Households: No GST on individual health insurance policies

- Ease of Compliance: Automated refunds and registration system to unblock working capital

Sector-Wise GST Rate Reductions

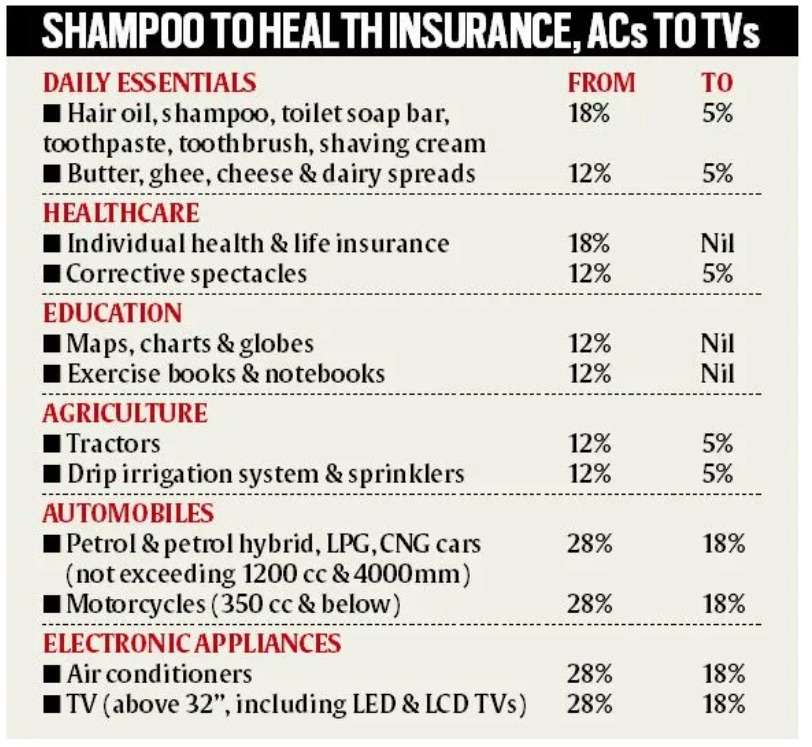

The reforms slash rates across essential goods, healthcare, education, agriculture, automobiles, and electronics, making everyday items more affordable.

| Category | Items | Old Rate | New Rate |

|---|---|---|---|

| Daily Essentials | Hair oil, shampoo, soap, toothpaste, toothbrush, shaving cream | 18% | 5% |

| Butter, ghee, cheese & dairy spreads | 12% | 5% | |

| Healthcare | Individual health & life insurance | 18% | Nil |

| Corrective spectacles | 12% | 5% | |

| Education | Maps, charts & globes | 12% | Nil |

| Exercise books & notebooks | 12% | Nil | |

| Agriculture | Tractors | 12% | 5% |

| Drip irrigation systems & sprinklers | 12% | 5% | |

| Automobiles | Petrol, hybrid, LPG, CNG cars (≤1200cc & ≤4000mm) | 28% | 18% |

| Motorcycles (≤350cc) | 28% | 18% | |

| Electronics | Air conditioners | 28% | 18% |

| TVs above 32” (LED & LCD) | 28% | 18% |

Why GST 2.0 Matters

- Consumer Relief – Essential goods, insurance, education material, and farm equipment are now cheaper.

- Business Growth – Simplified tax slabs, automated refunds, and lower working capital needs will support MSMEs and startups.

- Economic Boost – With fewer slabs, India aligns closer to global tax practices, strengthening transparency and compliance.

The rollout of GST 2.0 from September 22, 2025, marks a new era in India’s taxation framework. With a sharper focus on consumer affordability, compliance ease, and business efficiency, this reform is set to benefit both households and industries alike.

For businesses navigating the evolving compliance landscape, expert guidance is crucial. Discover how Sankhla Corporate Services can help you stay ahead with comprehensive labour laws compliance, audits, and advisory services tailored for modern businesses.

Big News for India! GST 2.0 is here – simpler slabs, lower rates on essentials, healthcare, education & more! Businesses & households both win! #GSTUpdate #IndiaEconomy

https://www.westdelhiescorts.com/