Introduction to ESI Act:

The Employees’ State Insurance Act of 1948, also known as the ESI Act, was established by the Government of India to offer a range of benefits to employees in situations such as sickness, maternity, disability, and death resulting from work-related injuries.

Objectives of the ESI Act 1948:

The main goal of this act is to safeguard employees in the organized sector by implementing a thorough insurance program that ensures their socio-economic well-being. The key aim of the ESI Act is to deliver social security to employees by shielding them from financial hardships caused by health-related problems and workplace injuries as per Indian labour laws.

Importance ESI compliance for Employers-

Legal Obligation: Employers must ensure they comply with the ESI Act by registering their employees and making timely contributions.

Risk Mitigation: ESI helps mitigate the financial risk associated with workplace accidents, sickness, or employee death, providing a safeguard for both employees and employers.

Overview of the Employees’ State Insurance Act, 1948

| Feature | Description |

|---|---|

| Objective | To provide social security and health insurance to employees in case of sickness, maternity, disability, and death due to employment injury. |

| Applicability | Applies to factories and establishments with 10 or more employees. |

| Coverage | Employees earning up to ₹21,000 per month. |

| Administration | Managed by the Employees’ State Insurance Corporation (ESIC). |

Key Provisions in Employees State Insurance Act :

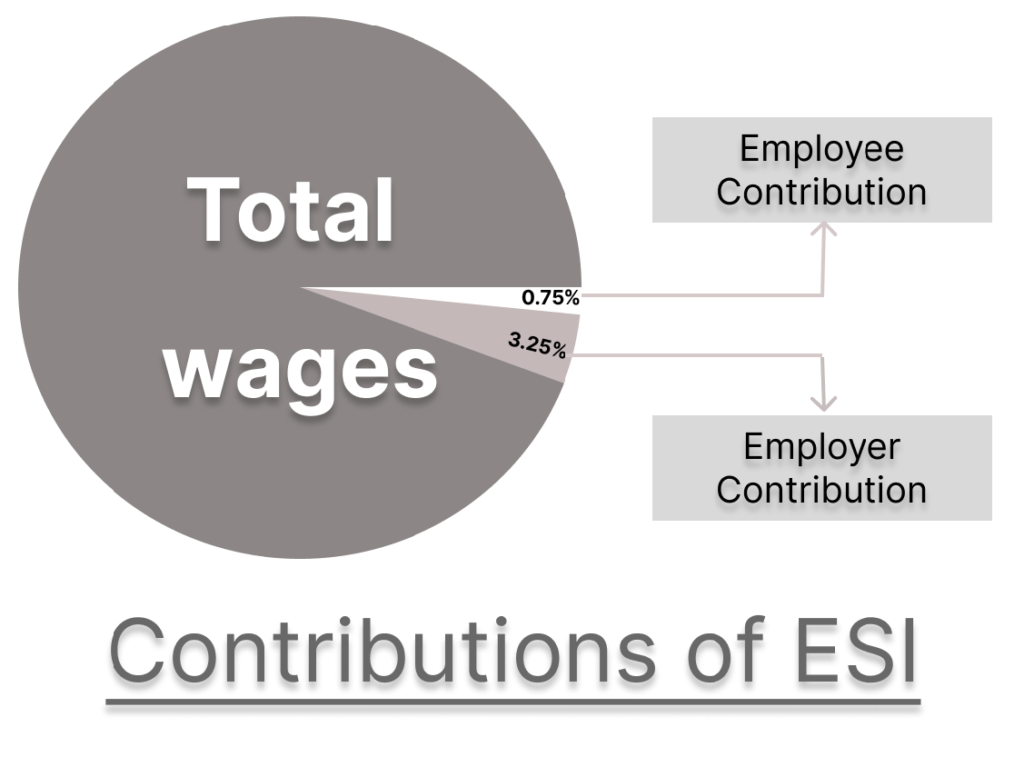

Contributions

Funding for the ESI scheme comes from contributions made by both ESI employers and employees. Employers contribute 3.25% of the employee’s wages, while employees contribute 0.75%. These contributions are deposited into the ESI Fund.

Applicability

The ESI Act is applicable to all factories and establishments with 10 or more employees, covering the entire nation of India except for specific areas where exemptions are specified by the ESI Corporation.

Administration

The administration of the ESI Act falls under the jurisdiction of the Employees’ State Insurance Corporation (ESIC), which operates as an independent corporation under the Ministry of Labour and Employment.

Coverage

Initially, the ESI Act included employees earning up to ₹15,000 per month, which was later increased to ₹21,000 per month in the most recent updates. Employees earning above this threshold are not encompassed by the ESI Act.

The ESIC is responsible for overseeing the implementation and enforcement of the ESI Act 1948, as well as managing the ESI Fund.

Special Provisions for Women Workers

Maternity Benefits: Women workers are entitled to maternity leave (up to 26 weeks) and medical benefits.

Creche Facilities: Employers with 50 or more employees must provide crèche facilities for female workers with children under 6 years.

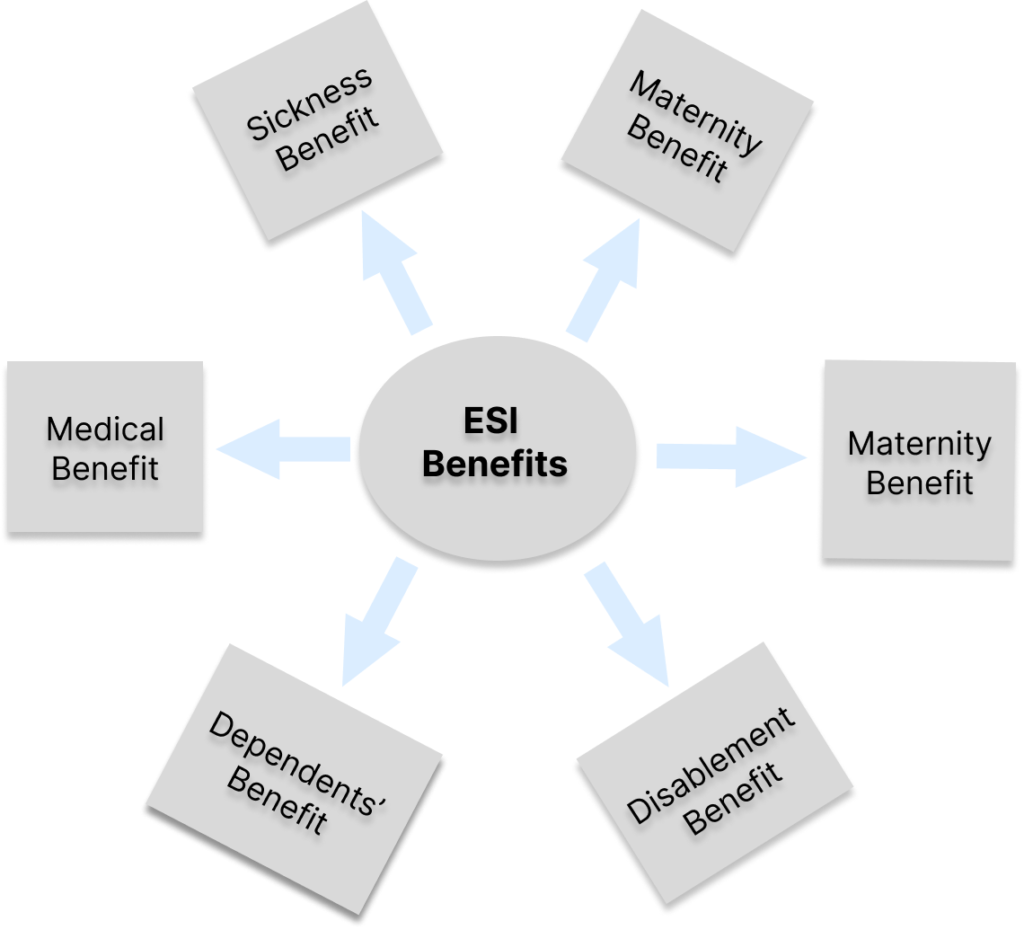

ESI Benefits:

| Benefit | Description | ESI Eligibility/Conditions |

|---|---|---|

| Sickness Benefit | Cash compensation for loss of wages due to sickness. | Paid at 70% of average daily wages for up to 91 days in a year. |

| Maternity Benefit | Paid leave for female employees during maternity. | Up to 26 weeks of leave. |

| Disablement Benefit | Compensation for temporary or permanent disablement due to employment injury. | Temporary: 90% of average daily wages. Permanent: Varies based on the extent of disability. |

| Dependents’ Benefit | Monthly ESIC payments to dependents of an insured person who dies due to employment injury. | Percentage of the wage, based on the number of dependents. |

| Medical Benefit | Comprehensive medical care for insured persons and their families. | Available at ESI dispensaries, hospitals, and recognized medical institutions. |

| Other ESI Benefits | Includes funeral expenses, rehabilitation allowance, and vocational rehabilitation. | Varies based on specific conditions and ESIC eligibility criteria. |

Contributions / Responsibilities of ESI Employers:

| Contributor | ESI Contribution Rate | Details |

|---|---|---|

| Employee | 0.75% of the wages | Contribution towards ESI fund. |

| Employer | 3.25% of the wages | Deducted from the employee’s salary. |

| Total Contribution | 4.00% of the wages |

- Employers are required to register their establishments under the ESI Act within 15 days of the employees state insurance act coming into effect.

- ESIC contributions for eligible employees must be deducted and paid by employers on or before the 15th of the following month.

- Accurate records of employees, wages, and contributions must be maintained as per ESIC requirements.

- ESIC employers should communicate with employees about their rights and benefits under the ESI scheme and ensure they are informed about available medical facilities.

ESI Act Compliance and Inspections:

The Employees’ State Insurance Act, 1948 (ESI Act) ensures that employees receive social security benefits as outlined in the Act. To ensure compliance, the Employees’ State Insurance Corporation (ESIC) conducts regular inspections of establishments covered by the Act.

To ensure Labour laws compliance with the ESI Act, the ESIC appoints inspectors who have the authority to conduct inspections at establishments, review records, and ensure adherence to the Act’s provisions.

ESIC Employers are obligated to maintain records and registers as specified by the esi act, and they must provide the necessary information to the inspectors during their visits.

Key Compliance Requirements:

| Requirement | Description |

|---|---|

| Registration | Employers must register their establishments with the ESIC within 15 days of the Act becoming applicable. |

| Contribution Payments | Contributions must be paid by the 15th of the following month. |

| Record Maintenance | Maintain records of wages, attendance, and other employment details. |

| Return Filing | File periodic returns, such as Form 5 (Return of Contributions) and Form 6A (Annual Return). |

| Display of Information | Display notices and posters at the workplace informing employees about their rights and ESI benefits. |

Inspections and Penalties under the ESI Act:

- 1. ESIC designates inspectors to ensure adherence to the ESI Act. These inspectors are authorized to conduct visits to any premises falling under the purview of the employee’s state insurance act 1948.

- 2. Inspectors are empowered to enter and scrutinize any premises during reasonable hours to verify ESI compliance with the Act. They have the authority to review and authenticate records, registers, and documents related to employment and wages. Additionally, inspectors can interrogate both ESIC employers and employees regarding compliance with the Act.

- 3. Throughout an inspection, the inspector typically assesses the proper registration of the establishment and its employees. They validate the accuracy of contributions made and records maintained. Inspectors also confirm that employees are receiving the entitled benefits under the Act.

- 4. Following inspections, inspectors compile detailed reports based on their findings. These reports encompass observations on compliance status, identified discrepancies, and recommendations for corrective measures.

| Aspect | Details |

|---|---|

| Inspectors | Appointed by ESIC to enforce compliance, inspect premises, and examine records. |

| Inspection Powers | Inspectors can enter premises, verify records, and question employers and employees. |

| Penalties for Non-Compliance | Fines, imprisonment, interest, and damages for delays in contributions or record-keeping failures. |

Consequences of Non-Compliance

Failure to comply with the provisions of the ESI Act can result in penalties for employers, including fines and imprisonment. Different types of violations, such as non-payment of contributions, failure to maintain records, or failure to submit returns, carry specific penalties as prescribed by the ESI Act 1948.

Late payment of contributions can incur interest and damages, which the employer is obligated to pay in addition to the outstanding contributions.

Continued non-compliance may prompt the ESIC to initiate legal actions.

ESI Employers may be subjected to litigation and incur additional costs as a consequence of non-compliance.

Best Practices for Ensuring Compliance for Employers

| Practice | Description |

|---|---|

| Regular Audits | Conduct internal audits to ensure compliance with the ESI Act. |

| Employee Training | Train HR and payroll staff on compliance and educate employees about their rights and benefits. |

| Timely Payments | Ensure timely payment of contributions and filing of returns. |

| Record Keeping | Maintain accurate and up-to-date records as required by the ESI Act. |

| Engagement with ESIC | Communicate with ESIC officials for guidance and address labour laws compliance issues proactively. Foster open communication with ESIC officials and seek guidance on labour laws compliance matters. |

By adhering to these compliance requirements and adequately preparing for inspections, employers can fulfil their obligations under the ESIC Act 1948 and provide essential social security benefits to their employees.

Record Maintenance with form:

- Register of Employee – Form 6

- Accident Book – Form 11

- Inspection Book – 102 A

- Contribution of Employee – Form 32

Registration Process

Employer’s Responsibility: Employers must register their establishments with the ESIC if they meet the criteria.

Employee Registration: Employees are enrolled upon joining the company, and their details are maintained by the ESIC.

Form Requirements: Both the employer and employee must fill out appropriate forms (e.g., Form 1 for employer registration, Form 3 for employee registration).

Digitalization of the ESI Scheme

Online Portal: ESIC has made the registration process and claims submission easier through its ESIC portal.

e-SHRAM Card: The ESIC is linked to the e-SHRAM portal, which helps workers access a variety of social security benefits.

ESI Mobile App: The ESIC app allows employees and employers to manage their contributions, medical claims, and view benefits online.

Important Amendments in ESI act

Here are some of the important amendments in the Employees State Insurance (ESI) Act over the years:

1. The Employees’ State Insurance (Amendment) Act, 2010

- Increase in Wage Ceiling: The monthly wage ceiling for coverage under the ESI scheme was increased from ₹10,000 to ₹15,000. This allows more workers in the organized sector to benefit from the scheme.

- Enhanced Benefits for Workers: Introduced provisions for increased cash benefits in case of sickness, maternity, and medical care for insured workers.

2. The Employees’ State Insurance (Amendment) Act, 2016

- Wage Ceiling Revision: The wage ceiling for coverage was increased again to ₹21,000 (₹25,000 for employees with disabilities), expanding the scope of the ESI scheme to more workers in different sectors.

- New Wage Limits for Disability: The amendment introduced a higher wage limit for workers with disabilities (₹25,000), making them eligible for the ESI scheme.

- Self-Employed Workers: The act introduced provisions allowing certain self-employed or voluntary contributors to join the scheme on their own initiative, making it more inclusive.

3. The Employees’ State Insurance (Amendment) Act, 2019

- Implementation of ESI Benefits to Gig Workers: The amendment paved the way for gig and platform workers to benefit from the ESI scheme, recognizing the changing workforce dynamics.

- Online Claiming System: The government made changes to streamline the process for workers to submit and track medical claims and other benefits through an online portal.

- Digitalization: Efforts were made to transition the entire ESI framework into digital platforms, reducing paperwork and improving transparency and accessibility.

4. The Employees’ State Insurance (Amendment) Act, 2020

- Increase in Coverage of Establishments: The amendment allowed the expansion of the ESI scheme to include establishments with fewer than 10 employees in certain areas, especially in some states and industries.

- Introduction of Medical Insurance for Informal Workers: It widened the coverage for workers in the informal sector through various measures, including partnerships with private insurers.

5. The Employees’ State Insurance (Amendment) Act, 2021

- Provisions for Remote Workers and Pandemic Relief: With the COVID-19 pandemic, the ESI Act was amended to provide relief to workers impacted by the pandemic. This included medical treatment for COVID-19, even for workers in non-ESI-covered establishments.

- Provisions for Telemedicine and Digital Healthcare: The amendment introduced provisions for telemedicine and digital healthcare services under the ESI scheme, facilitating remote consultations, especially in rural and underserved areas.

- Reduced Contribution for Employers: In response to the pandemic’s economic impact, the government reduced the employer’s contribution rate temporarily to provide relief to businesses.

6. Future Amendments (Anticipated)

- Wider Coverage for Gig and Platform Workers: Future amendments are expected to enhance coverage for gig workers, with the government focusing on ensuring that informal and contractual workers receive social security benefits.

- Further Digital Integration: Plans are underway to further integrate the ESIC system into digital platforms, reducing manual interventions and improving efficiency.

- Expanding Maternity Benefits: The government is considering increasing maternity benefits for workers under the ESI scheme, aiming for a more robust social safety net for women workers.

Conclusion:

The ESI Act, 1948, plays a vital role in delivering social security and health insurance to employees in India. Through the provision of diverse ESI benefits and guaranteeing medical care, the employees state insurance act strives to improve the well-being of workers and their families. Employers are required to comply with the provisions of the ESI Act to ensure adherence and contribute to the overarching objective of providing social security to employees.

Employees State Insurance (ESI) Act FAQs:

Is ESI contribution mandatory for all eligible employees?

Answer: Yes, ESI contributions are mandatory for all employees earning ₹21,000 or less per month in establishments covered under the Act. Both employer and employee contributions are compulsory to ensure continued ESI coverage and benefits.

How can an employer register their establishment with ESIC?

Answer: Employers can register their establishment on the ESIC online portal by providing details about the business and employees. Once registered, employers receive an ESIC code number and are responsible for making monthly contributions on behalf of eligible employees.

What is the role of the ESI number or IP number?

Answer: The ESI number (or IP number) is a unique identifier for each insured employee under the ESI scheme. It allows employees to access medical services, check contributions, and manage claims on the ESIC portal. This number is crucial for all ESI-related activities.

Can ESI benefits be used for family members?

Answer: Yes, the ESI Act provides medical benefits for employees’ immediate family members, covering medical expenses for spouses, children, and dependent parents at ESIC hospitals and dispensaries, as well as select panel hospitals.

What penalties are imposed on employers for ESI non-compliance?

Answer: Employers failing to comply with ESI regulations may face penalties, including interest on overdue contributions, fines, and potential legal action. Non-compliance includes failure to register eligible employees or not submitting contributions on time.

What is the dependent benefit under the ESI Act?

Answer: The dependent benefit provides monthly financial support to family members of an insured employee who passes away due to a work-related injury or occupational disease. This benefit ensures that dependents receive a portion of the employee’s wages.

How can employees check their ESI contributions and claim status?

Answer: Employees can check their ESI contribution details, claim status, and other personal information through the ESIC portal or the UMANG app. By entering their IP number, employees can view contribution history, benefit eligibility, and claim progress.

How does the maternity benefit work under the ESI Act?

Answer: The maternity benefit under the ESI Act offers full wages for a period of up to 26 weeks for women employees who are on maternity leave. This benefit also covers pre- and post-natal medical expenses for both the mother and child.

What is the sickness benefit under the ESI Act?

Answer: The sickness benefit provides eligible employees with 70% of their average daily wages for up to 91 days in a year during certified medical leave due to illness. This benefit helps employees financially during prolonged illness.

How can employees access ESI medical services?

Answer: Employees can access ESI medical services through a network of ESI hospitals, dispensaries, and panel clinics affiliated with ESIC. They can also avail of medical treatment, surgeries, and hospitalization at ESIC facilities or authorized private hospitals in certain cases.

What is the role of the Employees’ State Insurance Corporation (ESIC)?

Answer: The Employees’ State Insurance Corporation (ESIC) administers and enforces the ESI Act, providing health benefits and overseeing hospitals, dispensaries, and medical facilities for ESI beneficiaries. ESIC also handles claims, manages contributions, and ensures compliance with the ESI Act.

How are ESI contributions calculated?

Answer: ESI contributions are shared between the employer and the employee. Currently, the employee contributes 0.75% of their wages, while the employer contributes 3.25%, totaling 4% of the employee’s wages.

What is the Employees State Insurance (ESI) Act?

Answer: The Employees State Insurance (ESI) Act, 1948 is a comprehensive social security law in India, providing medical, cash, maternity, disability, and dependent benefits to employees earning ₹21,000 or less per month. It is managed by the Employees’ State Insurance Corporation (ESIC) and applies to establishments with 10 or more employees.

Who is eligible for ESI coverage under the ESI Act?

Answer: Employees earning a monthly wage of ₹21,000 or less are eligible for ESI benefits. The Act is applicable to establishments with 10 or more employees, such as factories, shops, hotels, restaurants, and educational institutions.

What benefits are provided under the ESI Act?

Answer: The ESI Act provides a range of benefits, including medical care, sickness benefits, maternity benefits, disability benefits, unemployment allowance, and dependent benefits. These benefits offer financial and medical support to employees and their families during illness, injury, or maternity.

Contact Us for Labour Laws Compliances

Connect with top ESIC consultants for expert guidance on employment regulations. Ensure full compliance, avoid costly penalties, and safeguard employee rights with the best industry professionals.