Introduction:

The Labour Welfare Fund Act serves as a mechanism for social security, intending to enhance the well-being of labourers across diverse sectors. Various regions within India have implemented their unique adaptations of the Act, showcasing distinctions in terms of reach, scope, and advantages.

Key Provisions of the Labour Welfare Fund Act

Historical Context of Labour Welfare Fund Act

The LWF Act originated in a period marked by increased industrialization, the rise of labour movements, and the growing demand for enhanced social security for employees. The evolution of labour welfare laws in India has its roots in the early 1900s, shaped by local circumstances as well as international labour norms as per labour laws.

Historical Context and Evolution

Industrial Expansion: During the late 19th and early 20th centuries, India experienced a notable increase in industrialization, with a focus on sectors such as textiles, jute, coal mining, and plantations. This era was characterized by harsh working conditions, extended work hours, meagre salaries, and a lack of social welfare for labourers.

Labour Advocacy: The initial labour movements and trade unions emerged to push for improved working conditions, equitable wages, and social welfare provisions. This phase witnessed the emergence of prominent labour figures and the establishment of diverse labour associations.

Pre-Independence Era:

- The Factories Act of 1881 was one of the initial labour laws in India designed to enhance the working conditions of factory employees, with a focus on improving the situation for children.

- Enacted in 1926, the Trade Unions Act acknowledged the workers’ entitlement to establish unions and partake in collective bargaining.

- The Royal Commission on Labour in India in 1931 put forth numerous suggestions for labour welfare, which subsequently influenced the creation of multiple labour legislations.

Post-Independence Initiatives:

The Labour Investigation Committee in 1946 emphasized the importance of implementing extensive labour welfare initiatives and proposed the creation of welfare funds.

The Constitution of India in 1950 included the Directive Principles of State Policy, which required the state to guarantee the well-being of workers and offer social security.

State Variations of Labour Welfare Fund Act

The Labour Welfare Fund Act is instituted on a state-by-state basis, leading to differences in the details of the Act across various states. Among the states that have their unique Labour Welfare Fund Acts are:

- Labour welfare fund Delhi

- Gujarat Labour Welfare Fund Act

- The Karnataka labour welfare fund act 1965

- Haryana Labour Welfare Fund Act

- The Punjab labour welfare fund act 1965

- The labour welfare fund Kerala

- Labour welfare fund Andhra Pradesh

- The Maharashtra Labour Welfare Fund Act (1953) was a pioneering piece of legislation that laid the foundation for comprehensive welfare fund acts in India.

- The Tamil Nadu Labour Welfare Fund Act (1972) stands out as a significant state-level initiative aimed at enhancing the welfare of workers in the region.

- Several other states, such as Gujarat, Karnataka, Punjab, Haryana, Delhi labour welfare fund followed suit over the years by introducing their own versions of the Labour Welfare Fund Act to support the well-being of workers.

Labour welfare fund contribution in India:

The Labour Welfare Fund (LWF) in India is a mandatory contribution set by the government to support the well-being of workers. The funds are used for various initiatives to enhance the living and working conditions of employees, such as healthcare, education, housing, and recreational services.

Key Points about Labour Welfare Fund Contribution:

Applicability of Labour welfare Fund:

The LWF is applicable in specific states and union territories of India, typically for establishments with a minimum number of employees (usually 5 or more). It covers both organized and unorganized sectors.

Contributors of Labour Welfare Fund

Employers typically deduct contributions from employees’ salaries and match them.

Both employers and employees usually contribute to the fund, with rates and frequency varying by state. In some regions, the government also contributes.

Contributions are generally made annually, but can also be bi-annual or quarterly based on state regulations.

Funds Utilization of Labour Welfare Fund

Funds collected are used for worker welfare, including health services, education for workers’ children, vocational training, housing, and recreational facilities.

It is mandatory for employers to adhere to the specified deadlines and submit their contributions to the relevant state Labour Welfare Board.

- The primary goal of the Labour Welfare Fund Acts was to offer financial aid for various welfare activities, including medical care, educational scholarships, housing, recreational facilities, and family welfare programs for workers and their families.

- These Acts were designed to establish a social security system to protect workers, especially those in the informal sector who did not have access to formal social security benefits.

- By providing a range of welfare benefits, the Acts aimed to raise the living standards of workers and foster a more just and inclusive society.

Labour Welfare Fund Contribution Rates:

Contribution rates differ by state.

Below table provides the amount of contribution payable by Employer (ER) and Employee (EE) in Indian National Rupees (INR per monthly or half yearly or annual periodicity)

| State/UT | Employee Contribution (INR) | Employer Contribution (INR) | Frequency |

|---|---|---|---|

| Maharashtra | 36 per year | 72 per year | Annually |

| Karnataka | 40 per year | 20 per year | Annually |

| Tamil Nadu | 10 per year | 20 per year | Annually |

| Gujarat | 3 per month | 6 per month | Monthly |

| Haryana | 5 per month | 10 per month | Monthly |

| Punjab | 1 per month | 2 per month | Monthly |

| Andhra Pradesh | 30 per year | 70 per year | Annually |

| Telangana | 30 per year | 70 per year | Annually |

| West Bengal | 3 per month | 5 per month | Monthly |

| Madhya Pradesh | 10 per year | 20 per year | Annually |

| Odisha | 40 per half-year | 80 per half-year | Bi-annually |

| Rajasthan | 20 per year | 40 per year | Annually |

| Kerala | 20 per half-year | 20 per half-year | Bi-annually |

| Delhi | 0.75 per month | 2.25 per month | Monthly |

| Uttar Pradesh | 6 per half-year | 12 per half-year | Bi-annually |

Inspections and Compliance under Labour Welfare Fund Act

The Labour Welfare Fund (LWF) Act typically includes provisions for inspections and compliance to ensure that employers adhere to the regulations regarding the fund. Here’s a general overview of how inspections and compliance are managed under the Act:

Inspections under the Labour Welfare Fund Act

1. Appointment of Inspectors:

- The state government designates inspectors who are responsible for ensuring adherence to the regulations outlined in the Labour Welfare Fund Act.

- Inspectors can be officials from the labour department or other authorized entities.

2. Powers of Inspectors:

- As part of their inspection process, they may also conduct interviews with employees and employers.

- Inspectors possess the authority to conduct thorough inspections of establishments to verify compliance with the provisions of the Act.

- They are authorized to enter any premises or establishment covered under the Act during working hours for the purpose of carrying out inspections.

- Inspectors are empowered to scrutinize records, accounts, registers, and other relevant documents pertaining to the labour welfare fund payment. in order to ensure labour laws compliance.

Labour Welfare Fund Act Compliances

1. Registration and Contribution:

- Employers must register their establishments covered under the Labour Welfare Fund Act with the appropriate authorities and make contributions according to the specified rates and deadlines.

2. Maintenance of Records:

No need of Registers in case records under Payment of Wages is Maintained:

- Employers have a responsibility to maintain accurate records related to the Labour Welfare Fund, such as contributions, employee information, wages, and other pertinent details.

- These records should be regularly updated and accessible for inspection by authorized personnel.

3. Submission of Reports:

- Employers may need to submit periodic reports or returns to the authorities, providing details on contributions to the Labour Welfare Fund and other relevant information

4. Compliance with Welfare Measures:

It is essential for employers to ensure that welfare measures funded by the Labour Welfare Fund are effectively implemented for the well-being of employees and their families.

Employers are required to adhere to the regulations concerning the utilization of the Labour Welfare Fund for the welfare measures outlined in the Act.

Penalties for Non-Compliance

1. Fines and Penalties:

- In the event of non-compliance, the Labour Welfare Fund Act has the authority to impose penalties, such as fines and other punitive measures.

- Authorities have the power to penalize employers who violate the provisions of the Act.

2. Legal Action:

Failure to comply with the Labour Welfare Fund Act can lead to legal action being taken against the employer, which may involve prosecution and potential court proceedings.

Labour welfare fund benefits

The Labour Welfare Fund (LWF) in India aims to enhance the welfare of workers by providing a range of benefits. These benefits may differ from state to state, but generally include the following:

Key Benefits of the Labour Welfare Fund:

Here are some of its salient feature objects of the payment of gratuity act 1972:

Example Benefits by State:

Maharashtra

Medical reimbursement and financial aid for health emergencies.

Educational scholarships and financial support for workers’ children’s education.

Housing loans and subsidies.

Tamil Nadu

Maternity benefits and educational scholarships.

Financial aid for funerals and distress relief.

Skill development programs and training workshops.

Karnataka

Health camps and medical treatment support.

Scholarships for higher education and technical courses.

Recreational and community development activities.

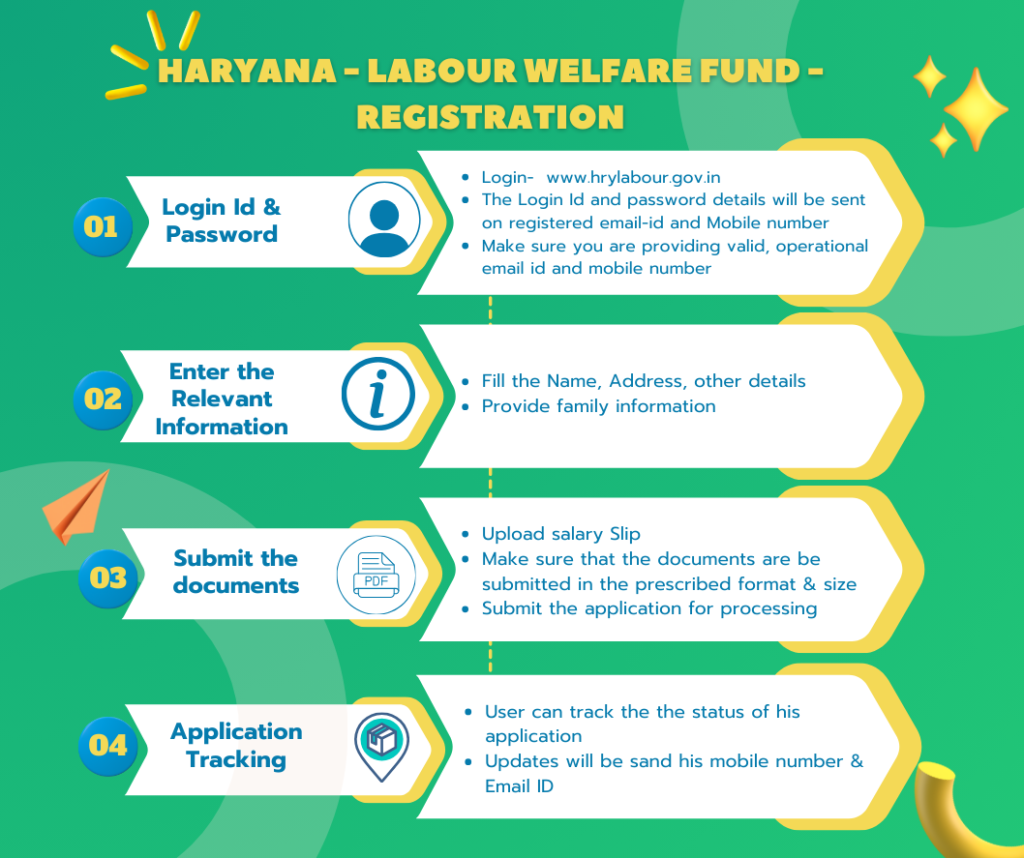

Haryana Labour Welfare Fund Registration:

Summery of Labour Welfare Fund Act:

The Labour Welfare Fund Act plays a crucial role in enhancing the welfare of workers across different industries through mandatory contributions from both employers and employees. By utilizing these funds for welfare activities, the Act aims to improve the quality of life and provide added security to workers and their families. While specific provisions and implementation methods may differ by state, the primary objective of promoting worker welfare remains constant across various jurisdictions.

Labour Welfare Fund Act FAQs:

What happens if an employer fails to contribute to the Labour Welfare Fund?

Answer: Employers who fail to contribute to the Labour Welfare Fund are subject to penalties, including fines or legal action. The state government can take strict actions against non-compliant employers to ensure workers receive their rightful benefits.

How can workers avail benefits under the Labour Welfare Fund Act?

Answer: Workers can avail benefits by applying through the respective Welfare Fund Board. They need to ful-fill eligibility criteria and submit the required documents for processing claims related to medical aid, education, housing, and other welfare measures.

Who regulates the Labour Welfare Fund Act?

Answer: The Labour Welfare Fund Act is regulated by state governments, which establish welfare boards for each industry. The boards are responsible for the administration of the fund, ensuring compliance, and distributing the benefits to eligible workers.

Is there a limit to the contributions made under the Labour Welfare Fund Act?

Answer: Yes, the amount contributed to the Labour Welfare Fund is capped, and the rates vary depending on the state and industry. The ceiling on contributions is set by the government to ensure fair participation of employers and employees.

How are contributions made under the Labour Welfare Fund Act?

Answer: Both employers and employees are required to contribute a fixed percentage of wages to the Labour Welfare Fund. The contributions are based on the wages paid to workers, and the rate is determined by the state government.

What are the objectives of the Labour Welfare Fund Act?

Answer: The primary objectives of the Labour Welfare Fund Act are to provide financial support to workers for their welfare, including benefits for education, health, housing, and legal aid. It aims to improve the quality of life and well-being of laborers.

What are the benefits provided under the Labour Welfare Fund Act?

Answer: The benefits include medical assistance, financial aid for education, housing schemes, and legal assistance. The Fund also provides for the welfare of workers in case of accidents, death, and retirement, ensuring their financial security.

Who is covered under the Labour Welfare Fund Act?

Answer: The Act applies to workers employed in factories, mines, plantations, and other industrial establishments. It typically covers employees who work for an organization that employs 10 or more workers.

How is the Labour Welfare Fund administered?

Answer: The Labour Welfare Fund is administered by a Welfare Fund Board formed by the respective state government. The fund is generated through contributions from both employers and employees, with the government also contributing in certain cases.

Contact Us for Labour Laws Compliance

Find expert Labour Laws Compliance consultants to ensure your business meets all regulatory requirements. Get comprehensive compliance solutions, tailored advice, and avoid penalties. Safeguard your company with our professional consultancy services.