Introduction to the Payment of Gratuity Act:

The Payment of Gratuity Act, holds significant importance in India as it strives to ensure social security for employees through the provision of gratuity payments.

Gratuity meaning: Gratuity refers to a one-time payment provided by an employer to an employee as a gesture of gratitude for their dedicated and commendable service upon retirement, resignation, or unfortunate demise.

Historical Context:

Requirement for Legislation: The lack of a legal framework resulted in inconsistent gratuity payments across various industries, leaving numerous workers devoid of this essential benefit.

Pre-1972: Prior to the implementation of this legislation, there were no established regulations mandating employers to provide gratuity to their employees in India.

Provisions of the 1972 Payment of Gratuity Act:

Salient features of the gratuity payment Act 1972:

The Payment of Gratuity Act provides for the payment of gratuity to employees in recognition of their long and meritorious service.

Here are some of its salient feature objects of the payment of gratuity act 1972:

Inspections and Compliance under Payment of Gratuity Act 1972

Inspections and compliance mechanisms play a crucial role in ensuring that employers adhere to the regulations set forth in the Payment of Gratuity Act, 1972, and fulfil their obligations towards gratuity payments for their employees. By conducting inspections, reviewing records, and enforcing compliance, authorities can safeguard the rights of employees and promote adherence to the statutory requirements of the payment Act.

Inspections under the Payment of Gratuity Act rules:

- Appointment of Inspectors: Inspectors may be appointed by the relevant government under Section 13 of the Act to oversee compliance with its provisions. These inspectors are typically officials from the labour department or other authorized bodies.

- Powers of Inspectors: Inspectors are empowered to inspect establishments covered by the payment Act to ensure compliance. They have the authority to enter any premises during working hours, conduct inspections, and scrutinize relevant records and documents.

- Verification of Records: Inspectors verify records pertaining to gratuity payments, including the calculation of gratuity amounts, eligibility criteria, and payment timelines.

Payment of Gratuity compliance:

- Eligibility and Calculation: Employers must adhere to the eligibility criteria and calculation methods outlined in the Act when determining gratuity payments for eligible employees. It is their responsibility to accurately calculate gratuity amounts based on the employee’s salary and length of service.

- Timely Payment as per labour laws in India: Employers are required to ensure timely payment of gratuity to eligible employees upon retirement, resignation, death, or disablement due to accident or illness. Gratuity payments must be disbursed within thirty days from the date they become due to the employee.

- Maintenance of Records: Employers must maintain accurate records of gratuity payments, which should include information about eligible employees, calculation methods, payment dates, and other relevant details. These records need to be regularly updated and accessible for inspection by authorized personnel.

Penalties for Non-Compliance:

- Fines and Prosecution: Employers who fail to comply with the provisions of the Payment of Gratuity Act may be subject to penalties such as fines and legal actions. The severity of the penalties may vary based on the nature of the violation as outlined in the Act.

- Legal Liability: Non-compliance with the Payment of Gratuity Act could result in legal liabilities for employers, including potential claims for unpaid gratuity amounts by affected employees. Employers may also be required to compensate employees for any financial losses resulting from non-compliance with the Act.

Important Sections in the payment of gratuity act 1972:

The Payment of Gratuity calculator :

The Payment of Gratuity Act, 1972, outlines a specific method for determining the gratuity payment owed to eligible employees. This method involves considering the employee’s last salary and the duration of their service.

Gratuity calculation formula:

Gratuity = (Last drawn salary × 15/26) × Number of years of completed service

Here are the key components of the formula:

- Last drawn salary refers to the basic salary and dearness allowance (if applicable) received by the employee at the time of their employment termination.

- 15 26 in gratuity calculation: The fraction 15/26 represents 15 days’ wages for each year of completed service. The Act defines a month as consisting of 26 working days.

- The number of years of completed service is rounded off to the nearest whole number. Any fraction of a year beyond six months is considered as one year.

- Also gratuity calculator for private employees

To simplify the calculation process, you can follow these steps:

- Determine the employee’s last drawn salary, which includes the basic salary and dearness allowance.

- Calculate the total number of years of completed service.

- Apply the formula mentioned above to calculate the gratuity amount owed to the employee.

- Gratuity calculator online

- Also a gratuity calculation for private employees by this formula.

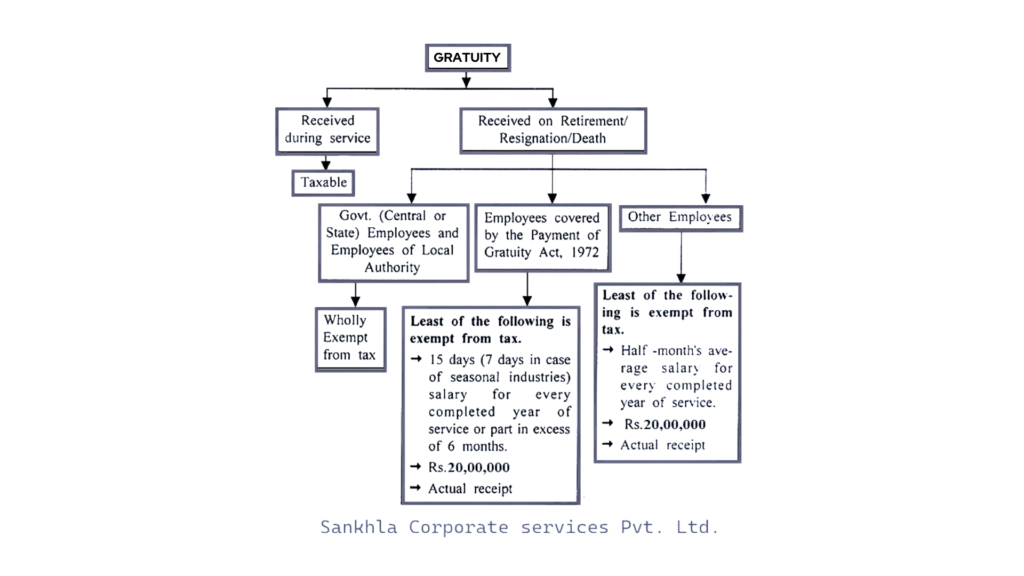

The Tax on gratuity in India:

It received by an employee in India is taxable under the Income Tax Act, 1961

Gratuity received by government employees is fully exempt from income tax.

For employees covered under the Payment of Gratuity Act, 1972, gratuity is tax-exempt up to ₹20 lakhs. Any amount exceeding this limit is taxable.

The tax exemption is based on the least of the actual gratuity received, 15 days’ salary for each year of service, or ₹20 lakhs.

Employees not covered by the Act, like those in small establishments, have different tax treatment. Their gratuity is taxable as per the Income Tax Act, 1961.

Employers must deduct tax at source if the gratuity exceeds the exempted limit.

Tax treatment varies for public sector, non-covered government, and non-government employees. Specific circumstances and provisions apply.

Payment of Gratuity Act FAQs:-

Are there any recent amendments to the Payment of Gratuity Act?

Answer: Recent amendments raised the maximum tax-free gratuity limit to ₹20 lakh, making it more beneficial for employees. These amendments enhance retirement benefits, aligning gratuity with inflation and rising cost of living.

What are the penalties for employers not complying with the Payment of Gratuity Act?

Answer: Non-compliance with gratuity provisions can lead to penalties, including fines and potential imprisonment for employers. This enforces the law’s commitment to ensuring that eligible employees receive their gratuity.

Employers who fail to comply with the provisions of the Payment of Gratuity Act may face fines and legal consequences. This includes penalties for not paying gratuity within the stipulated time.

What is the maximum limit on gratuity under the Payment of Gratuity Act?

Answer: As per recent amendments, the maximum gratuity pay-out under the Act is capped at ₹20 lakh. This limit applies to both government and private sector employees, ensuring a substantial retirement benefit for long-term employees.

The maximum amount of gratuity payable under the Act is capped at ₹20 lakh for employees in both public and private sectors, ensuring a substantial retirement benefit for long-term employees.

How does the Payment of Gratuity Act protect employees’ rights?

Answer: The Act mandates gratuity payment to employees who meet eligibility criteria, protects against delayed payments, and offers legal recourse if gratuity is unfairly withheld. This ensures employees receive benefits for their long service.

Can an employee be denied gratuity under the Payment of Gratuity Act?

Answer: Gratuity may be denied if an employee is dismissed for misconduct, such as fraud or theft, as per the provisions of the Act. However, such denial must comply with legal procedures to be valid.

When is gratuity paid under the Payment of Gratuity Act?

Answer: Gratuity is typically paid at the time of retirement, resignation, or death of an employee. The employer must settle gratuity within 30 days of the employee’s exit, ensuring prompt payment to eligible employees.

Gratuity must be paid within 30 days of an employee’s termination, resignation, retirement, or death. If the employer fails to pay within this time frame, they are required to pay interest on the delayed amount.

Is gratuity taxable in India?

Answer: Gratuity is tax-free up to ₹20 lakh for government employees, and up to ₹10 lakh for private sector employees, as per current Indian tax laws. Amounts exceeding these limits are subject to income tax.

Gratuity is tax-free up to ₹20 lakh for government employees, and for private sector employees, the limit is ₹10 lakh. Amounts exceeding these limits are subject to income tax under the Income Tax Act, 1961.

How is gratuity calculated under the Payment of Gratuity Act?

Answer: Gratuity is calculated using the formula: Gratuity = Last Drawn Salary × 15/26 × Years of Service. Here, “last drawn salary” includes basic salary and dearness allowance, and the formula helps determine the lump sum pay-out for eligible employees.

Who is eligible for gratuity under the Payment of Gratuity Act?

Answer: Employees who have completed five years of continuous service with an employer are eligible for gratuity. This includes those working in factories, mines, oilfields, plantations, and other establishments with 10 or more employees.

What is the Payment of Gratuity Act, 1972?

Answer: The Payment of Gratuity Act, 1972 is an Indian law that ensures gratuity payment to employees as a financial benefit for long-term service. Gratuity is typically paid when an employee leaves an organization after serving for at least five years.

Summary of Payment of Gratuity Act:

The Payment of Gratuity Act, 1972, plays a vital role as a social security measure for employees in India, ensuring they receive financial benefits upon retirement, resignation, or termination. By establishing a statutory framework for gratuity calculation and payment, the Act aims to enhance employee welfare and promote social justice in the country.

Thank you for Reading !

Contact Us for Labour Laws Compliance

Stay compliant with essential labour laws. Explore comprehensive guides on statutory compliance, latest regulations, and expert advice for employers. Ensure legal adherence and protect your business today.