Introduction to Professional Tax:

In India, the Professional Tax Act is a state-level tax law that requires people in trades, professions, callings, and employment to pay taxes.

In India, state governments levy professional taxes on individuals who work as paid professionals, including doctors, lawyers, chartered accountants, and other professionals. In states where the Act is in force, employers are obliged to withhold taxes from workers’ salaries.

History of the Professional Tax:

The Professional Tax Act in India has its historical roots in the early attempts by state governments to raise more money by directly taxing the income of people working in a variety of trades, jobs of work, and occupations.

The 1960s and 1980s saw the implementation of professional tax legislation in many states. This legislation was usually in the form of income slabs, meaning that higher earners paid a higher tax rate.

Several states, including Maharashtra, Gujarat, Karnataka, Tamil Nadu, and Andhra Pradesh, enacted professional tax acts and adjusted the structure to suit their own budgetary needs.

Every state has its own laws, exclusions, and compliance standards, which are frequently customized to fit the financial and administrative resources of the region.

Pre-Independence Era

- During the pre-independence era in India, colonial and princely state governments implemented a range of direct and indirect taxes to generate revenue for administrative and public services.

- Some princely states did impose income or occupation taxes to generate funds.

Post-Independence Fiscal Policies

- Following India’s independence, the country adopted a federal structure, with taxation powers divided between the central and state governments as outlined in the Constitution of India.

- Taxation of professions, trades, callings, and employments was given to state governments under Entry 60 of the State List in the Seventh Schedule.

Professional taxation is still a significant source of funding for many state governments today. The basic ideas of the tax act have not changed over time, despite changes to its rates and structures.

Employers are obligated to withhold professional tax from their employees’ wages and submit it to the state government, whereas self-employed individuals must personally remit the tax.

Constitutional Amendments and Updates

In compliance with the Profession Tax Act of 1987 (as amended), the Commercial Taxes Department has been designated as the principal agency in charge of obtaining Professional Tax payments from professionals within the State. The Department is currently engaging in one-on-one interactions with taxpayers as part of its endeavour to highlight the urgent need for prompt settlement of Profession Tax obligations.

Significant Events

- 1950: The Constitution of India incorporates regulations for professional tax in Article 276.

- 1960s-1970s: States commence the implementation of professional tax laws.

- 1988: The Constitution (Sixtieth Amendment) Act raises the maximum professional tax limit to INR 2,500.

- 1990s-Present: Ongoing enhancements and adjustments to professional tax laws by states to improve collection and adherence.

Constitutional Provisions in Professional Tax

The Indian Constitution’s Article 276 expressly gives state governments the authority to tax occupations, trades, vocations, and employment.

The annual maximum for professional tax was initially set at INR 250. However, the Constitution (Sixtieth Amendment) Act, 1988 changed this to INR 2,500 annually.

- According to the Constitution, the Profession Tax can be levied up to a maximum of Rs.2500/- per annum, with a minimum slab as low as Rs.110/- per annum. This equitable levy is based on the principle of ability to pay.

- Taxpayers fulfil their Income Tax obligations by the deadline of 31st March. It is important to note that, absent any additional levies, the profession tax paid by individuals and organizations is fully reimbursable against their income tax obligations.

- In fact, the Commercial Tax Department considers the Profession Tax to be a benevolent and advantageous tax. It serves as a reciprocal arrangement between taxpayers and their own community and city. The Department has faith that businesses and people will fulfil their Profession Tax obligations on time and with pride in their community.

- Constitutional amendments and updates played a crucial role during this time. In particular, the Constitution (Sixtieth Amendment) Act of 1988 was a landmark act that raised the maximum professional tax limit in India from INR 250 to INR 2,500 annually. This adjustment aimed to reflect the changing economic conditions and inflation prevalent during that period.

Provisions in Professional Tax Act in India

In India, the Professional Tax Act is a comprehensive piece of legislation that governs the assessment, collection, and administration of professional tax. These regulations are designed to ensure that professionals, traders, workers, and employees contribute to the state’s revenue, while also incorporating provisions for exemptions, appeals, and grievance resolution mechanisms to uphold fairness and adherence to the law.

State wise Professional tax rate in India:

In India, state-by-state variations in professional tax rates are based on income brackets. Rate tables for a few well-known states are shown below, providing a general idea of how professional tax levies are typically structured.

1. Maharashtra Professional Tax Act

- Rates: Up to INR 2,500 per year.

- Frequency: Employers receive monthly payments, while self-employed people receive annual payments.

- Exemptions: Senior citizens, people with disabilities, and specific employee categories.

| Monthly Salary (INR) | Monthly Salary (INR) |

|---|---|

| Up to 7,500 | Nil |

| 7,501 to 10,000 | 175 |

| Above 10,000 | 200 (300 in February) |

2. Karnataka Professional Tax Act

- Rates: Up to INR 2,500 per year.

- Frequency: Monthly payments for employers; annual payments for self-employed individuals.

- Exemptions: Senior citizens, individuals with disabilities, and members of the armed forces.

| Monthly Salary (INR) | Professional Tax (Monthly) |

|---|---|

| Up to 15,000 | Nil |

| Above 15,000 | 200 |

3. West Bengal Professional Tax Act

- Rates: Up to INR 2,500 per year.

- Frequency: Employers receive monthly payments, while self-employed people receive annual payments.

- Exemptions: Individuals with disabilities, members of the armed forces, and those earning below a certain threshold.

| Monthly Salary (INR) | Professional Tax (Monthly) |

|---|---|

| Up to 10,000 | Nil |

| 10,001 to 15,000 | 110 |

| 15,001 to 25,000 | 130 |

| 25,001 to 40,000 | 150 |

| Above 40,000 | 200 |

4. Tamil Nadu Professional Tax Act

| Half-Yearly Salary (INR) | Professional Tax (Half-Yearly) |

|---|---|

| Up to 21,000 | Nil |

| 21,001 to 30,000 | 135 |

| 30,001 to 45,000 | 315 |

| 45,001 to 60,000 | 690 |

| 60,001 to 75,000 | 1,025 |

| Above 75,000 | 1,250 |

5. Andhra Pradesh Professional Tax Act

| Monthly Salary (INR) | Professional Tax (Monthly) |

|---|---|

| Up to 15,000 | Nil |

| 15,001 to 20,000 | 150 |

| Above 20,000 | 200 |

Professional Tax

Important Considerations

Registration and Enrolment of professional tax Act:

Who Must Register: The professional tax department of the applicable state requires registration from all employers (aside from government offices) whose workers are subject to professional tax.

Required Documents:

- Proof of establishment (Certificate of Incorporation, Partnership Deed-Examples)

- PAN card of the business entity

- Business address proof

- Employee details and salary structure

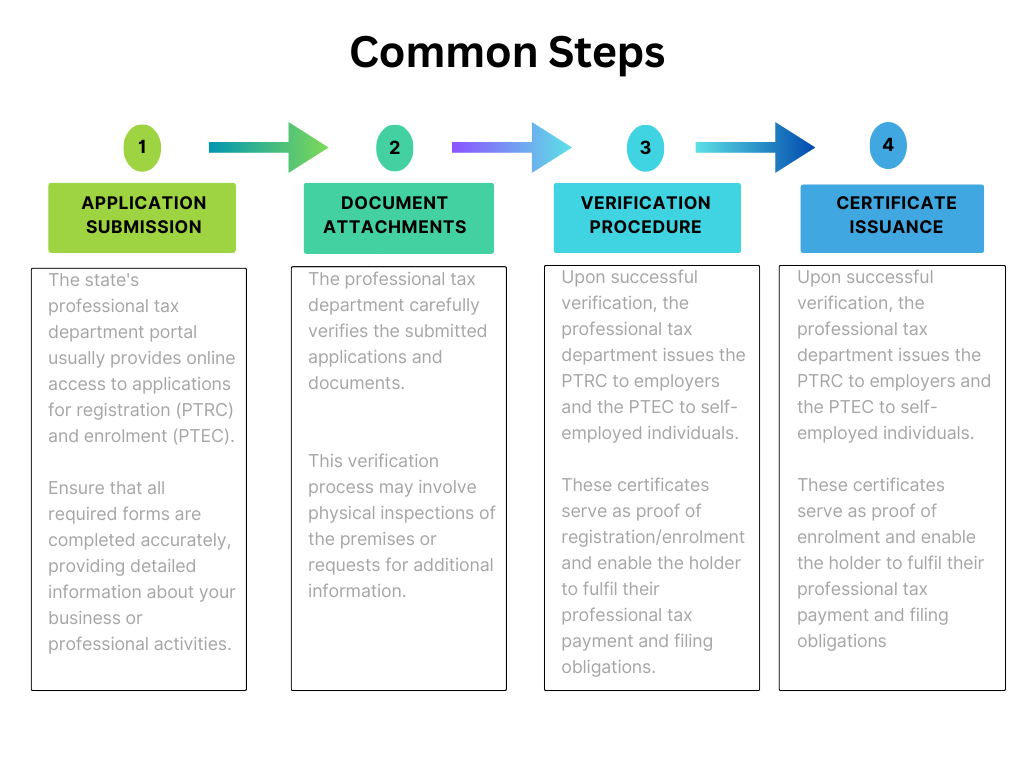

Registration Process of professional tax Act:

- Application Submission: Fill out and submit the registration form (usually available online on the state’s professional tax department website).

- Verification: The documents and application will be examined by the tax authorities.

- Certificate Issuance: The employer will get a Professional Tax Registration Certificate (PTRC) following a successful verification process.

Who Must Enrol: Anyone who works in a profession, trade, calling, or employment and is responsible for paying professional tax must register with the state’s professional tax department.

Required Documents:

- PAN card

- Address proof

- Proof of profession (e.g., professional degree, trade license)

Process:

Application Submission: Complete and submit the enrolment form.

Verification: The tax authorities will review the application and documents.

Certificate Issuance: Upon successful verification, the individual will be issued a Professional Tax Enrolment Certificate (PTEC).

Common Steps in Registration and Enrolment in Professional Tax

Compliance Obligations:

- Employers must withhold professional taxes from their workers’ pay-checks and send them to the state government by the deadline.

- Self-employed individuals are responsible for directly paying taxes based on their income brackets.

- Employers must submit periodic tax returns (monthly, quarterly, or annually) that provide details of the professional taxes deducted and paid.

- Individuals who work for themselves must also file tax returns in accordance with state regulations.

- Payroll payments, professional tax deductions, and tax payments must all be accurately documented by employers and enrolled individuals.

- These records should be readily available for inspection by tax authorities if necessary.

Late Registration/Enrolment:

Penalties will be imposed for failure to register or enrol within the specified timeframe after becoming liable.

Non-Payment or Late Payment:

Professional taxes that are not paid on time will result in interest and penalties.

Non-Filing of Returns:

Failure to file tax returns by the specified deadline will result in penalties.

Conclusion of professional tax Act:

In India, state-level legislation known as the Professional Tax Act is in place to ensure that people working in various professions and jobs pay their taxes. States vary with regard to their tax rates, exemptions, and compliance requirements. To avoid fines and interest charges, it is critical that self-employed individuals and employers adhere to the rules established by their individual states.

According to Indian labour laws, professional tax contributes significantly to state government revenue, which is then used to finance a range of public services and developmental initiatives.

Professional Tax Act important FAQs:

What is Professional Tax, and why is it charged?

Professional Tax is a state-level tax levied on income earned by salaried individuals, professionals, freelancers, and businesses. This tax contributes to state revenue and funds various local civic services. While it is mandatory, professional tax rates vary by state in India.

Who is liable to pay Professional Tax in India?

In India, Professional Tax is mandatory for salaried employees, self-employed individuals, professionals like doctors, lawyers, and freelancers, and businesses. Employers deduct it from employees’ salaries, while self-employed individuals pay it directly.

What are the Professional Tax rates in different states?

Professional Tax rates differ across states in India, with maximum monthly limits usually capped at ₹200, or ₹2,500 annually. States like Maharashtra, Karnataka, and West Bengal have defined slabs for professional tax based on income brackets.

How is Professional Tax calculated?

Professional Tax calculation depends on the individual’s income level and the state-specific tax slabs. Employers typically deduct this tax from employees’ salaries based on pre-defined monthly slabs, while self-employed individuals follow the state guidelines for filing and payment.

Is Professional Tax applicable to all states in India?

No, not all states in India levy Professional Tax. While it is charged in states like Maharashtra, Karnataka, Tamil Nadu, and West Bengal, states like Delhi and Haryana do not impose this tax. Each state has autonomy in deciding its implementation.

What is the penalty for non-payment of Professional Tax?

Failure to pay Professional Tax or late payment may result in penalties, including interest charges and fines. Penalty rates vary by state, but non-compliance can attract substantial fines and legal actions depending on the duration of default.

Are there any exemptions from Professional Tax?

Yes, certain individuals may be exempt from Professional Tax, including senior citizens, disabled individuals, and members of the armed forces. Exemption criteria vary across states, with specific provisions for select occupations and conditions.

Is Professional Tax deductible under Income Tax?

Yes, Professional Tax paid by individuals or employers is deductible under Section 16 of the Income Tax Act. This deduction applies to the tax paid in a financial year, offering relief on the taxable income amount.

What records are required for Professional Tax compliance?

For Professional Tax compliance, employers must maintain records of tax deducted, employee salary details, and remittance receipts. These records are essential during audits or inspections by the state tax department.

How can employers register for Professional Tax?

Employers must obtain a Professional Tax Registration Certificate (PTRC) and a Professional Tax Enrollment Certificate (PTEC) from their respective state tax departments. This registration enables employers to deduct and pay professional tax on behalf of their employees by Professional Tax Consultants.

Contact Us For Any Labour Laws Compliance

Stay compliant with labour laws. Learn essential labour law requirements, compliance tips, and updates. Ensure your business meets all legal obligations and protects employee rights effectively.