Introduction to EPF Act:

The Indian EPF Act, 1952, is a legislation implemented by the Government of India to ensure the financial well-being of employees after their retirement. It serves as a crucial social security scheme in the country, offering employees a financial safety net during their post-retirement years.

The PF Act applies to establishments that employ a minimum number of individuals, as determined by the government. Under this act, both employees and employers contribute a portion of the employee’s salary to the EPF scheme, which accumulates over time and can be accessed by the employee upon retirement.

The Indian EPF Act 1952 plays a vital role in providing social security, encouraging savings, and offering financial assistance to employees in India.

Historical Context of the Employees Provident Fund act

In post-independence India, the necessity for social security for industrial workers gave rise to the Employee Provident Fund Act of 1952. It is a testament to the government’s dedication to worker welfare and has been instrumental in giving millions of workers nationwide financial security.

There is important historical and socioeconomic background to the EPF Act in India.

- Following India’s independence in 1947, there was a strong emphasis on industrialization to stimulate the economy. However, concerns arose regarding the welfare of industrial workers, particularly in relation to their retirement benefits.

- During the 1950s, significant efforts were made to improve labour welfare and social security. One of the key measures implemented was the establishment of the Employee Provident Fund, which aimed to provide financial security to industrial workers during their retirement.

- The creation of the PF Act reflected the socialist ideals that were prevalent in post-independence India. The government’s objective was to create a safety net for workers, ensuring their financial well-being beyond their working years.

- As a result of the EPF Act rules, the Employees’ Provident Fund Organization (EPFO) was formed. This organization is responsible for overseeing the administration of provident funds and related schemes, managing the funds accumulated through contributions from both employees and employers.

- The Act played a crucial role in instilling a sense of security among industrial workers, thereby contributing to the stability of the workforce. This, in turn, supported the broader goal of economic development by ensuring a motivated and loyal workforce.

- Over the years, the Act has undergone various amendments to adapt to changing economic and social realities. These amendments have aimed to expand coverage, enhance benefits, and address emerging challenges faced by workers.

- The impact of the EPF Act of India on social security in India has been profound. It has provided millions of workers with the means to save for retirement, access housing loans, and meet other financial needs during their working lives.

- The Indian PF Act established a legal framework for the establishment, administration, and regulation of provident funds in India. It clearly defined the roles and responsibilities of employers and employees in relation to these funds.

Key reasons-The Employee Provident Fund act of 1952

The Employees Provident Fund (EPF) Act rules hold great significance in India as it establishes provident funds for employees in various establishments.

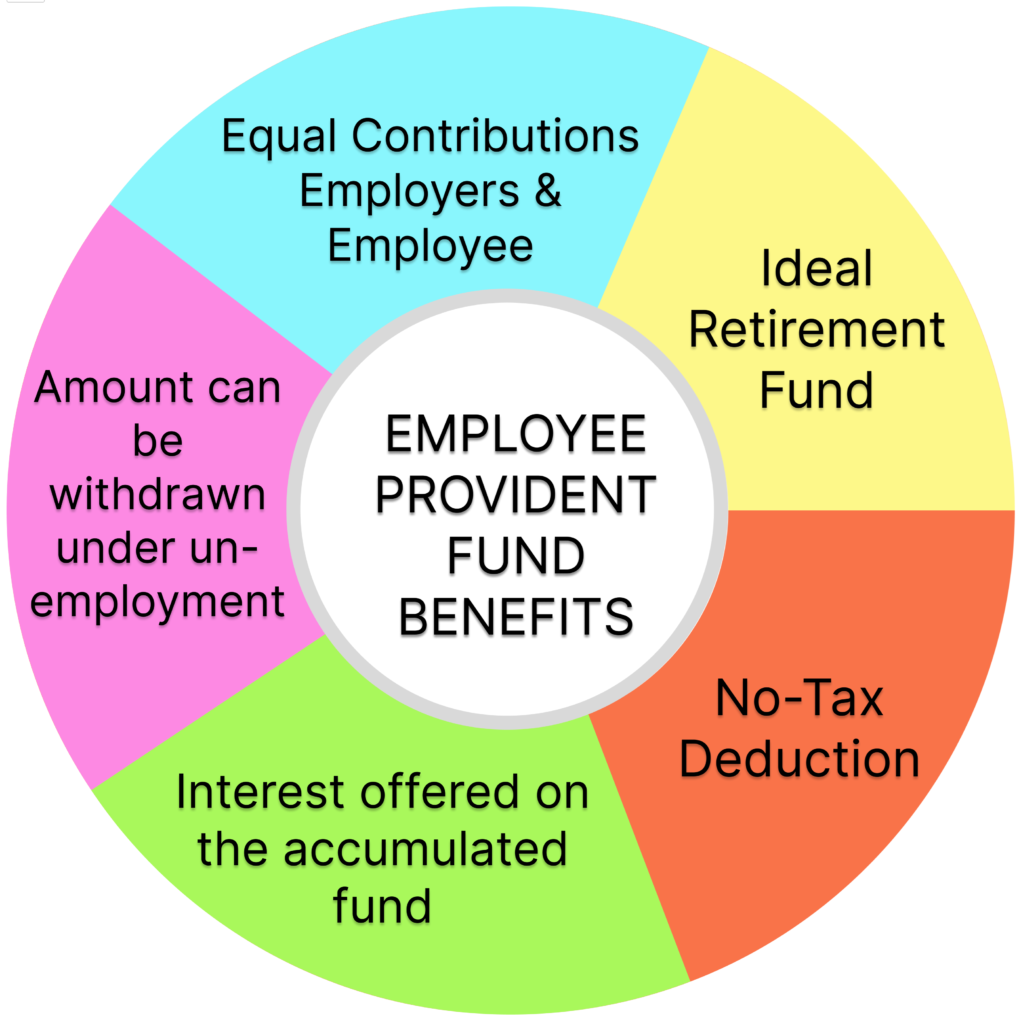

Here are several key benefits:

Key Provisions and rules of The EPF India act 1952

The PF Act of 1952, also known as the Employee Provident Funds and Miscellaneous Provisions Act 1952, lays out a comprehensive set of provisions aimed at providing social security to employees in India.

Here is a summary of the main provisions within the act:

Here are several key benefits:

EPF Act Compliance and Inspections:

Appointment: To guarantee adherence to the EPF Act and related programs, the Central Government appoints inspectors.

Role of Inspectors:

- Appointment: To guarantee adherence to the EPF Act and related programs, the Central Government appoints inspectors.

- Inspectors’ Authority: Inspectors are able to go inside and have a look at any location owned by an PF establishment compliance that the legislation covers.

- Examine and confirm pertinent records, accounts, and papers.

- Ask EPF employers and workers if they are complying with the act’s requirements.

- Make copies of records or document extracts.

Technology and Modernization: Automated Inspections

- Risk-Based Inspections: The EPFO employs risk-based inspection systems to identify establishments for audit based on predefined risk parameters. This approach helps focus resources on high-risk cases.

- Self-Compliance Reports: PF Employers can submit self-compliance reports online, reducing the need for physical inspections and promoting a culture of voluntary compliance.

PF Employer Obligations:

- Employers are obligated to register their establishment with the Employees’ Provident Fund Organisation (EPFO India) within one month of becoming liable under the act.

- On a monthly basis, typically by the 15th of the following month, employers must deposit both their and the employees’ contributions to the EPF account.

- Detailed records of wages, contributions, and employee details must be maintained by employers, as they are crucial for audits and inspections.

- EPF Employers are required to file periodic returns with the EPFO, including monthly, annual, and ad-hoc returns as specified..

Employee Entitlements:

- Information Accessibility: Workers are entitled to information regarding their contributions and the state of their provident fund account.

- Grievance Redressal: Workers can file grievances or reports of noncompliance with the employees provident fund organisation, which has procedures in place to handle these kinds of problems.

Technology and Modernization: Digital Compliance

- Online Systems: The EPFO has introduced digital platforms to facilitate compliance, including online registration, e-filing of returns, and digital payments of contributions.

- Universal Account Number (UAN): The introduction of the UAN has streamlined the management of employee accounts, ensuring portability and ease of tracking contributions.

Enforcement Mechanisms:

Actions Against Non-Compliance:

- EPF Penalties: Employers who fail to comply with the provisions of the EPF Act may face penalties, which can include fines and imprisonment. Specific penalties include:

- Fines for delayed payment of contributions.

- Additional damages for persistent default in compliance.

- Prosecution: The EPFO can initiate legal proceedings against defaulting employers, which may result in more severe penalties, including imprisonment.

Recovery of Dues:

Appointment of a receiver for the management of the employer’s property.

- Recovery Officers: The EPFO appoints Recovery Officers to recover outstanding dues from defaulting employers.

- Recovery methods can include:

- Attachment and sale of the employer’s property.

- Arrest and detention of the employer.

Grievance Redressal Mechanisms: EPFO Grievance Management System

- Online Portal: Employees can file grievances and follow their resolution through the EPFO’s online grievance management system.

- Ombudsman: Offering an extra level of grievance resolution, Ombudsman offices and an EPF Appellate Tribunal handle disputes and grievances pertaining to EPF.

Table of The Employee Provident Fund act 1952:

| Section | Provision | Description |

|---|---|---|

| Introduction | Title and Extent | The act may be called the Employees' Provident Funds and Miscellaneous Provisions Act, 1952. It extends to the whole of India except Jammu and Kashmir. |

| Section 2 | Definitions | Provides definitions for terms such as employee, employer, factory, wages, and other relevant terms used in the act. |

| Section 5 | Employees' Provident Fund Scheme | Establishes the Employees' Provident Fund Scheme, outlining the constitution and operation of the provident fund. |

| Section 6 | EPF Contributions | Specifies the contributions to be made by the employer and employee to the provident fund and pension fund. |

| Section 6A | Employees' Pension Scheme | Introduces the Employees' Pension Scheme for providing pension to employees after retirement. |

| Section 6C | Employees' Deposit Linked Insurance Scheme | Establishes the Employees' Deposit Linked Insurance Scheme to provide life insurance benefits to employees. |

| Section 7A | Determination of Moneys Due | Grants authority to determine the amount due from employers under the provisions of the act. |

| Section 7B | Review of Orders Passed Under Section 7A | Allows for the review of orders passed under Section 7A by the EPFO. |

| Section 7C | Power to Recover Damages | Empowers the recovery of damages for default in payment of contributions. |

| Section 8 | Mode of Recovery of Money Due from Employers | Specifies the procedures for recovering dues from employers, including attachment and sale of property. |

| Section 10 | Protection Against Attachment | Provides that the amount in the provident fund cannot be attached under any decree or order of any court in respect of any debt or liability incurred by the member. |

| Section 14 | Penalties | Details the penalties for contravening the provisions of the act, including fines and imprisonment for defaulting employers. |

| Section 14B | Power to Recover Damages | Provides for the recovery of damages for delayed payment of contributions. |

| Section 17 | Exemptions | Allows for exemptions from the provisions of the act for certain EPF establishments under specified conditions. |

| Section 18 | Power to Make Exemptions | Empowers the Central Government to exempt any PF establishment from the operation of the act. |

| Section 19 | Protection for Acts Done in Good Faith | Protects persons acting under the act in good faith from any legal proceedings. |

| Section 20 | Delegation of Powers | Allows the Central Government to delegate powers under the act to other authorities. |

| Section 21 | Power to Remove Difficulties | Grants the Central Government the power to remove difficulties in the implementation of the act. |

| Section 22 | Power to Make EPF1952 Rules | Empowers the Central Government to make rules to carry out the provisions of the act. |

| Section 27 | Inspectors | Describes the appointment, powers, and functions of inspectors to ensure pf statutory compliance with the PF act. |

| Section 30 | Protection of Action Taken Under the Act | Provides legal protection to actions taken in good faith under the act. |

| EPF Compliance | Employer Registration and Obligations | Employers must register with the EPFO and fulfil obligations such as timely contributions, maintaining records, and filing returns. |

| Grievance Redressal | Mechanisms for Addressing Grievances | Employees can lodge complaints and grievances through the EPFO's online portal and other established mechanisms, including the EPF Appellate Tribunal. |

| Technology | Digital Initiatives for Compliance and Monitoring | Introduction of the Universal Account Number UAN, online registration, e-filing of returns, and risk-based inspections to ensure pf statutory compliance as per labour laws. |

Meaning of EPFO Employee Provident Fund:

Employee financial stability during their retirement years is greatly aided by the Employee Provident Fund Act of 1952. The EPF system ensures that a corpus is accumulated that employees can access at retirement or other life events by requiring contributions from companies and employees. As one of the main social security programs in India, it provides benefits to millions of workers in numerous industries and sectors.

The EPFO Employee Provident Fund Act FAQs-

What is UAN, and how does it help with EPF?

Answer: The Universal Account Number (UAN) is a unique identification number for EPF members, which links multiple EPF accounts across different employers. UAN makes it easier to manage contributions, check balances, and transfer funds seamlessly when changing jobs.

Is the EPF amount taxable under the EPFO Act?

Answer: EPF contributions and the interest earned are tax-free if the employee has completed five years of continuous service. Partial or early withdrawals may be subject to tax if service conditions are not met.

How can an employee transfer their EPF when switching jobs?

Answer: Employees can transfer their EPF account to a new employer through the EPFO member portal by using their Universal Account Number (UAN). This ensures continuity of EPF contributions without needing to withdraw the fund each time they switch jobs.

What happens to EPF in case of an employee’s death?

Answer: In the event of an employee’s death, the accumulated EPF balance, pension, and insurance benefits under the Employees’ Deposit Linked Insurance Scheme (EDLI) are provided to the nominee or legal heirs, ensuring financial support for the family.

What is the pension component in EPF (Employee Pension Scheme – EPS)?

Answer: Under the Employee Pension Scheme (EPS), which is part of the EPFO Act, a portion of the employer’s EPF contribution is allocated to a pension fund. Employees are eligible for a monthly pension after retirement if they have completed at least 10 years of service.

Can EPF be withdrawn before retirement?

Answer: Yes, EPF can be partially withdrawn before retirement in specific cases, such as medical emergencies, marriage, housing, or higher education. Full withdrawal is allowed upon retirement, reaching 58 years, or after two months of unemployment.

How can employees check their EPF balance?

Answer: Employees can check their EPF balance through the EPFO member portal, the UMANG mobile app, by sending an SMS, or through a missed call service. These tools help employees track their balance, interest accrued, and overall contributions.

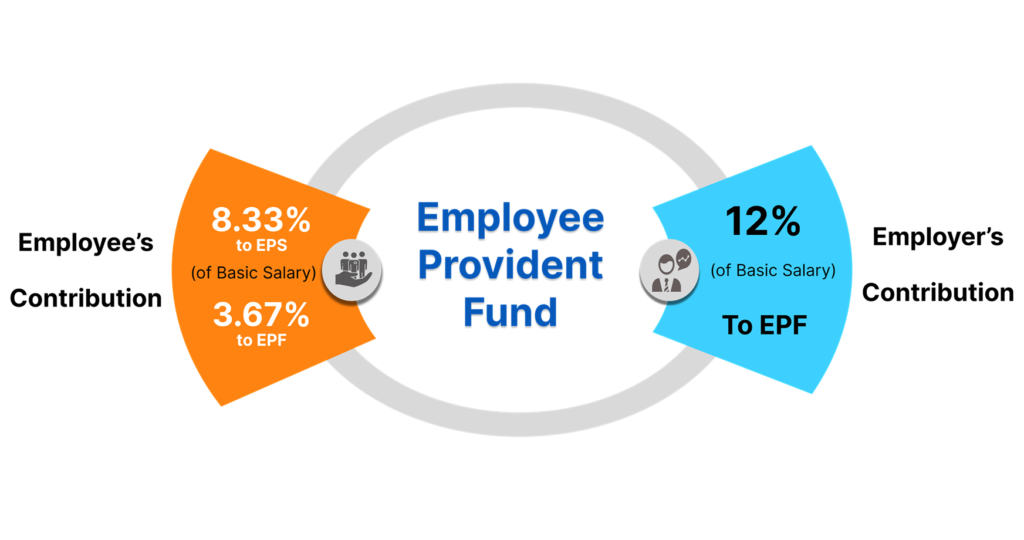

How are EPF contributions calculated under the EPFO Act?

Answer: Both employers and employees contribute 12% of the employee’s basic salary plus dearness allowance to the EPF account. This contribution is accumulated with interest over the employee’s working period and serves as a retirement fund.

What is the EPFO Employee Provident Fund Act?

Answer: The EPFO Employee Provident Fund (EPF) Act is an Indian law that mandates retirement savings for employees through contributions to a provident fund. Managed by the Employees’ Provident Fund Organisation (EPFO), the Act ensures that employees in covered sectors save for post-retirement financial security.

Who is eligible for EPF under the EPFO Act?

Answer: Employees earning a monthly wage up to ₹15,000 and working in companies with 20 or more employees are eligible for EPF coverage. However, organizations can voluntarily cover employees earning above the wage limit if agreed upon by both employer and employee

What are the benefits of the EPFO Employee Provident Fund?

Answer: EPF provides financial security for employees after retirement and includes benefits like pension (EPS), insurance (EDLI), and tax-free interest earnings. The savings can be withdrawn partially during emergencies like medical needs, housing, or children’s education.

Is EPF contribution mandatory for all employees?

Answer: EPF is mandatory for employees earning up to ₹15,000 per month in establishments with 20 or more employees. Employees with higher salaries can choose to opt-in for EPF voluntarily if the employer agrees to contribute.

What is the maximum limit of pf contribution by employee in India?

PF limit:

The highest amount an employee in India can contribute to the Provident Fund is ₹15,000 per month, encompassing both compulsory and optional contributions. The compulsory contribution is set at 12% of the basic salary along with the dearness allowance.

Who is EPFO member?

An EPFO member is an employee who is enrolled in the Employees’ Provident Fund (EPF) scheme, which is a retirement benefits program managed by the Employees’ Provident Fund Organisation (EPFO) in India. This scheme is mandatory for employees working in establishments that are registered under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952.

Key points about an EPF member:

- Eligibility: Any employee earning less than ₹15,000 per month is required to become a member, although higher-paid employees can also opt to join voluntarily.

- Contribution: Both the employee and employer contribute a percentage of the employee’s basic salary and dearness allowance to the EPF account.

- Benefits: EPF members receive a lump-sum payment at the time of retirement or can withdraw it early for specific reasons like housing, education, or medical emergencies.

- Universal Account Number (UAN): Each EPF member is assigned a unique Universal Account Number, which remains constant throughout their career and allows easy management of their PF accounts across different jobs.

This scheme helps employees save for their retirement and provides a financial cushion in emergencies.

Contact Us for Labour Laws Compliances

Get expert guidance from top Provident Fund Consultants. We are the top EPF consultancy. Ensure your business meets all legal requirements, avoids penalties, and protects employee rights. Discover tailored solutions and comprehensive compliance services.