The Union Territory of Chandigarh has announced the revised minimum wages for workers across different categories, effective from April 1, 2025, to September 30, 2025, under the provisions of the Minimum Wages Act.

This revision is linked to the increase in the Cost of Living Index for industrial workers. As per the notification, the average cost of living index for the half-year ending March 2025 has increased by 36 points (from 2185 to 2221). Consequently, the minimum wages for employees have been increased by ₹252 per month across categories.

Key Highlights of the Notification

Applicable Period

- From April 1, 2025 to September 30, 2025

Increase in Minimum Wages

- Rise of ₹252 per month for all categories of employees

- Neutralization rate: ₹7 per point increase in the cost-of-living index

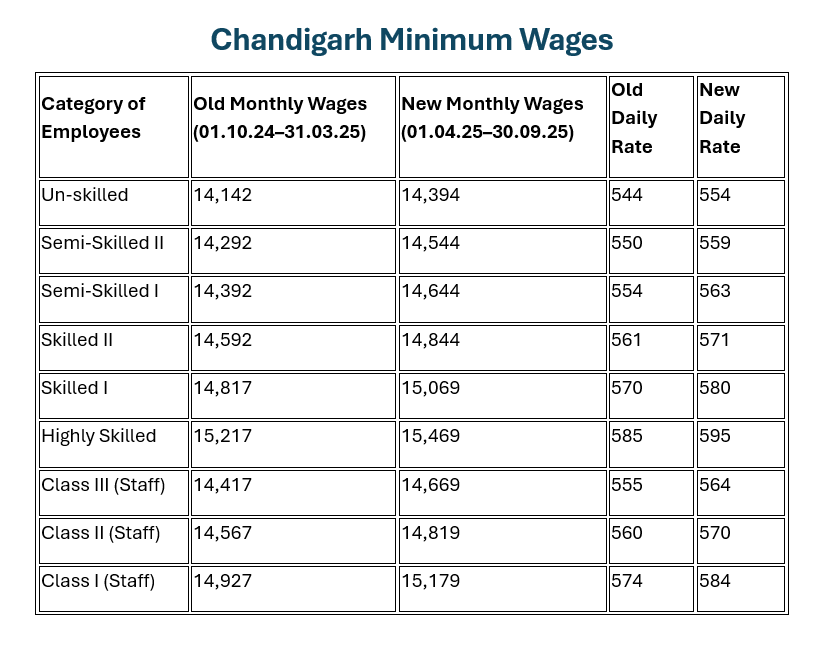

Revised Minimum Wages (01.04.2025 – 30.09.2025)

| Category of Employees | Old Monthly Wages (01.10.24–31.03.25) | New Monthly Wages (01.04.25–30.09.25) | Old Daily Rate | New Daily Rate |

| Un-skilled | 14,142 | 14,394 | 544 | 554 |

| Semi-Skilled II | 14,292 | 14,544 | 550 | 559 |

| Semi-Skilled I | 14,392 | 14,644 | 554 | 563 |

| Skilled II | 14,592 | 14,844 | 561 | 571 |

| Skilled I | 14,817 | 15,069 | 570 | 580 |

| Highly Skilled | 15,217 | 15,469 | 585 | 595 |

| Class III (Staff) | 14,417 | 14,669 | 555 | 564 |

| Class II (Staff) | 14,567 | 14,819 | 560 | 570 |

| Class I (Staff) | 14,927 | 15,179 | 574 | 584 |

Wages in Hotels, Restaurants, Tea Stalls, and Halwai Shops

For workers employed in hotels, restaurants, tea stalls, and halwai shops, wages have been fixed differently depending on whether the employer provides food and lodging:

| Category | Without Food & Lodging | With Food & Lodging (Deduction) | For Food & Lodging (Value) |

| Un-skilled | 14,394 | 12,595 | 1,799 |

| Semi-Skilled II | 14,544 | 12,726 | 1,818 |

| Semi-Skilled I | 14,644 | 12,813 | 1,831 |

| Skilled II | 14,844 | 12,988 | 1,856 |

| Skilled I | 15,069 | 13,235 | 1,834 |

| Highly Skilled | 15,469 | 13,535 | 1,934 |

| Class III Staff | 14,669 | 12,835 | 1,834 |

| Class II Staff | 14,819 | 12,967 | 1,852 |

| Class I Staff | 15,179 | 13,282 | 1,897 |

Important Notes

- The wage revision is directly linked to changes in the Cost of Living Index.

- Any rise or fall in the index will be adjusted in the ratio of 07:01 (7 parts in cash, 1 part in value of food).

- If accommodation is provided by the employer, a maximum deduction of ₹50 per month is permissible.

- The notification clearly defines the scope of unskilled, semi-skilled, skilled, highly skilled, and staff categories for better compliance.

What This Means for Employers & Employees

- Employers must ensure compliance with the revised wage structure to avoid penalties under the Minimum Wages Act.

- Employees are entitled to receive wages as per the new rates from April 1, 2025.

- The revision helps workers cope with inflation and ensures fair compensation based on the rising cost of living.

For businesses in Chandigarh, timely compliance with wage notifications is crucial. If you need assistance in statutory registers, records maintenance, or labour law compliance, visit Sankhla Corporate Services Pvt. Ltd..